Page 2 - WSAAG065_Real Estate Professional Trifold

P. 2

Finance a home purchase with no monthly mortgage payments . HECM for Purchase

2

Call me today! Frequently Asked Questions

What sources are allowed for the down

payment?

The sale of the existing home, gift money,

Give Senior Clients More Options How home equity conversion home buyer’s savings and other assets are all

With the HECM (Home Equity Conversion mortgages can benefit you: sufficient ways to source the required funds for

Mortgage) for Purchase loan, everybody wins! In- closing.

crease sales opportunities for yourself and move 3 Sell more homes to your senior clients

more inventory while offering a viable financial who are transitioning into retirement.

option to your senior clients. What sources CANNOT be used for the

3 Benefit from two potential transactions: a cash required to close?

A HECM for Purchase loan is a reverse mortgage

that is specifically designed to assist people age home sale and a purchase. Seller’s financing and concessions, credit card

62 or older purchase a home with no monthly 3 Assist clients with obtaining financing cash advances, bridge loans and subordinate

mortgage payments . financing cannot be used for closing.

2

they originally did not think they could

obtain without existing employment.

2 Borrower must continue to pay property taxes, What property types are eligible?

homeowner’s insurance, and home maintenance Single-family residences, FHA-approved

costs. condos, FHA-approved manufactured homes

built in 1990 or later, and Planned Unit

Developments (PUDs).

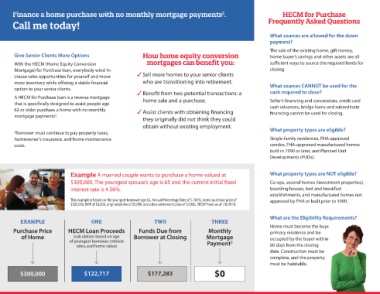

Example A married couple wants to purchase a home valued at What property types are NOT eligible?

$300,000. The youngest spouse’s age is 65 and the current initial fixed Co-ops, second homes (investment properties),

interest rate is 4.56%. boarding houses, bed and breakfast

establishments, and manufactured homes not

This example is based on the youngest borrower age 65, Annual Percentage Rate of 5.702%, home purchase price of approved by FHA or built prior to 1990.

$300,000, IMIP of $6,000, origination fee of $5,000, and other settlement costs of $3,983. HECM Fixed as of 1/8/2018.

What are the Eligibility Requirements?

EXAMPLE ONE TWO THREE

Home must become the buyer’s

Purchase Price HECM Loan Proceeds Funds Due from Monthly primary residence and be

of Home (calculation based on age Borrower at Closing Mortgage occupied by the buyer within

of youngest borrower, interest Payment 2

rates, and home value) 60 days from the closing

date. Construction must be

complete, and the property

must be habitable.

$300,000 $122,717 $177,283 $0