Page 5 - Your Guide to Accessing Home Equity 7.18.17

P. 5

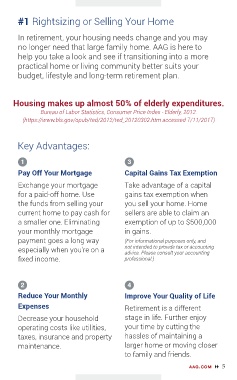

#1 Rightsizing or Selling Your Home

In retirement, your housing needs change and you may

no longer need that large family home. AAG is here to

help you take a look and see if transitioning into a more

practical home or living community better suits your

budget, lifestyle and long-term retirement plan.

Housing makes up almost 50% of elderly expenditures.

Bureau of Labor Statistics, Consumer Price Index - Elderly, 2012.

(https://www.bls.gov/opub/ted/2012/ted_20120302.htm accessed 7/11/2017)

Key Advantages:

1 3

Pay Off Your Mortgage Capital Gains Tax Exemption

Exchange your mortgage Take advantage of a capital

for a paid-off home. Use gains tax exemption when

the funds from selling your you sell your home. Home

current home to pay cash for sellers are able to claim an

a smaller one. Eliminating exemption of up to $500,000

your monthly mortgage in gains.

payment goes a long way (For informational purposes only, and

especially when you’re on a not intended to provide tax or accounting

advice. Please consult your accounting

fixed income. professional.)

2 4

Reduce Your Monthly Improve Your Quality of Life

Expenses Retirement is a different

Decrease your household stage in life. Further enjoy

operating costs like utilities, your time by cutting the

taxes, insurance and property hassles of maintaining a

maintenance. larger home or moving closer

to family and friends.

aag.com 8 5 ag.com 8 5

a