Page 1 - AAG187_Traditional Mortgage Checklist MPPs Flyer

P. 1

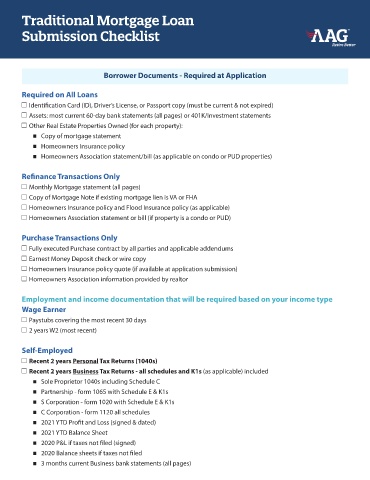

Traditional Mortgage Loan

Submission Checklist

Borrower Documents - Required at Application

Required on All Loans

c Identification Card (ID), Driver’s License, or Passport copy (must be current & not expired)

c Assets: most current 60-day bank statements (all pages) or 401K/Investment statements

c Other Real Estate Properties Owned (for each property):

n Copy of mortgage statement

n Homeowners Insurance policy

n Homeowners Association statement/bill (as applicable on condo or PUD properties)

Refinance Transactions Only

c Monthly Mortgage statement (all pages)

c Copy of Mortgage Note if existing mortgage lien is VA or FHA

c Homeowners Insurance policy and Flood Insurance policy (as applicable)

c Homeowners Association statement or bill (if property is a condo or PUD)

Purchase Transactions Only

c Fully executed Purchase contract by all parties and applicable addendums

c Earnest Money Deposit check or wire copy

c Homeowners Insurance policy quote (if available at application submission)

c Homeowners Association information provided by realtor

Employment and income documentation that will be required based on your income type

Wage Earner

c Paystubs covering the most recent 30 days

c 2 years W2 (most recent)

Self-Employed

c Recent 2 years Personal Tax Returns (1040s)

c Recent 2 years Business Tax Returns - all schedules and K1s (as applicable) included

n Sole Proprietor 1040s including Schedule C

n Partnership - form 1065 with Schedule E & K1s

n S Corporation - form 1020 with Schedule E & K1s

n C Corporation - form 1120 all schedules

n 2021 YTD Profit and Loss (signed & dated)

n 2021 YTD Balance Sheet

n 2020 P&L if taxes not filed (signed)

n 2020 Balance sheets if taxes not filed

n 3 months current Business bank statements (all pages)