Page 8 - Your Guide_AAG Jumbo Booklet

P. 8

Four Strategic Ways to Use a Jumbo

Reverse Mortgage Loan

1. Protection from Investment Downturns

You can set up a jumbo reverse mortgage loan at the

beginning of your retirement to help minimize risk to

your investment portfolio. This allows you to withdraw

from your investments during years of normal returns,

and in a down market, use proceeds from your jumbo

reverse mortgage. Borrowers have successfully used

this strategy to allow their investments some time to

recover from bear markets. Withdrawing from your

portfolio during down markets may also increase the

likelihood that you will deplete your investment assets

sooner than planned. By utilizing your home equity

with a jumbo reverse mortgage, you have a greater

chance of preserving your investment portfolio

longer.

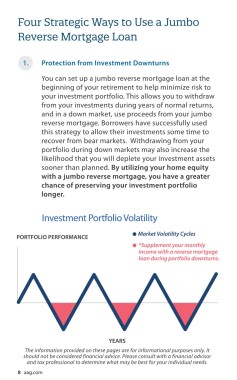

Investment Portfolio Volatility

Market Volatility Cycles

PORTFOLIO PERFORMANCE

*Supplement your monthly

income with a reverse mortgage

loan during portfolio downturns.

YEARS

The information provided on these pages are for informational purposes only. It

should not be considered financial advice. Please consult with a financial advisor

and tax professional to determine what may be best for your individual needs.

8 aag.com