Page 3 - AAG095_AAG Advantage for Purchase - Realtors

P. 3

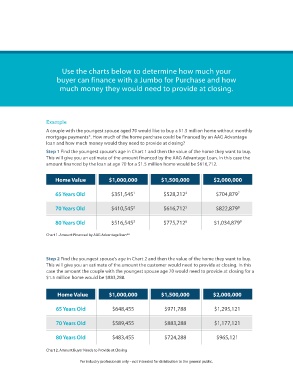

Use the charts below to determine how much your

buyer can finance with a Jumbo for Purchase and how

much money they would need to provide at closing.

Example

A couple with the youngest spouse aged 70 would like to buy a $1.5 million home without monthly

mortgage payments*. How much of the home purchase could be financed by an AAG Advantage

loan and how much money would they need to provide at closing?

Step 1 Find the youngest spouse’s age in Chart 1 and then the value of the home they want to buy.

This will give you an estimate of the amount financed by the AAG Advantage Loan. In this case the

amount financed by the loan at age 70 for a $1.5 million home would be $616,712.

Home Value $1,000,000 $1,500,000 $2,000,000

65 Years Old $351,545 1 $528,212 4 $704,879 7

70 Years Old $410,545 2 $616,712 5 $822,879 8

80 Years Old $516,545 3 $775,712 6 $1,034,879 9

Chart 1. Amount Financed by AAG Advantage loan**

Step 2 Find the youngest spouse’s age in Chart 2 and then the value of the home they want to buy.

This will give you an estimate of the amount the customer would need to provide at closing. In this

case the amount the couple with the youngest spouse age 70 would need to provide at closing for a

$1.5 million home would be $883,288.

Home Value $1,000,000 $1,500,000 $2,000,000

65 Years Old $648,455 $971,788 $1,295,121

70 Years Old $589,455 $883,288 $1,177,121

80 Years Old $483,455 $724,288 $965,121

Chart 2. Amount Buyer Needs to Provide at Closing

For industry professionals only – not intended for distribution to the general public.