Page 4 - WSAAG067_Financial Professional Brochure

P. 4

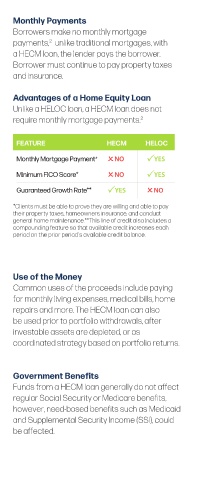

Information for Monthly Payments

Borrowers make no monthly mortgage

Financial Advisors payments, unlike traditional mortgages, with

2

and CPAs a HECM loan, the lender pays the borrower.

Borrower must continue to pay property taxes

and insurance.

Learn more about how Home Advantages of a Home Equity Loan

Equity Conversion Mortgage Unlike a HELOC loan, a HECM loan does not

(HECM) loans can offer an require monthly mortgage payments. 2

intelligent, tax-efficient solution

for homeowners 62 and over. FEATURE HECM HELOC

Monthly Mortgage Payment* O NO P YES

Minimum FICO Score* O NO P YES

Guaranteed Growth Rate** P YES O NO

1 What is a HECM? Receiving the Money

A HECM enables homeowners 62 and *Clients must be able to prove they are willing and able to pay

their property taxes, homeowners insurance, and conduct

older to access their home’s equity as tax free Borrowers can receive the cash from general home maintenance.**This line of credit also includes a

loan proceeds while eliminating their monthly a HECM loan in several ways: compounding feature so that available credit increases each

1

period on the prior period’s available credit balance.

mortgage payments. Borrower must continue to

pay property taxes and insurance.

Maintaining Ownership A single Monthly Line of Use of the Money

Borrowers retain ownership of their 2 lump sum payments credit Common uses of the proceeds include paying

home, but are subject to a lien granted for monthly living expenses, medical bills, home

to the lender. They are responsible for paying A combination of the above repairs and more. The HECM loan can also

property taxes, homeowners insurance, be used prior to portfolio withdrawals, after

maintaining the home, and otherwise complying investable assets are depleted, or as

with the loan terms. The borrowers may continue Example: An eligible couple lives in a home valued coordinated strategy based on portfolio returns.

to live in the home and the loan doesn’t have to at $450,000 and owes $100,000 on their mortgage.

be repaid until they leave, sell the home, or fail to They take out a HECM loan and pay off their

meet loan obligations. current mortgage which eliminates their monthly Government Benefits

payment and opens a $80,894 line of credit. Funds from a HECM loan generally do not affect

This line of credit grows over the next 10 years regular Social Security or Medicare benefits,

3 Loan Amount to be worth $140,542. Since they eliminated their however, need-based benefits such as Medicaid

The amount of the loan depends on: mortgage payment, there is no need to draw down and Supplemental Security Income (SSI), could

age of the youngest borrower or eligible non- their 401K to supplement monthly expenses. be affected.

borrowing spouse, current interest rates,

appraised value of the home and amount of This example is based on the youngest borrower age 65, home

purchase price of $450,000, IMIP of $9,000, origination fee of $6,000

equity in the home. and other settlement costs of $4,555. HECM ARM as of 11/16/2017.