Page 8 - AAG119_HECM for Purchase Booklet for Builders

P. 8

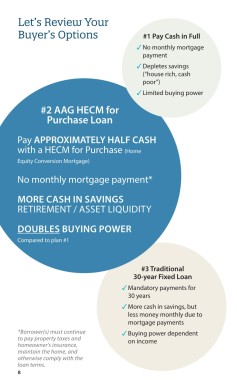

Let’s Review Your

Buyer’s Options #1 Pay Cash in Full

3 No monthly mortgage

payment

3 Depletes savings

(“house rich, cash

poor”)

3Limited buying power

#2 AAG HECM for

Purchase Loan

Pay APPROXIMATELY HALF CASH

with a HECM for Purchase (Home

Equity Conversion Mortgage)

No monthly mortgage payment*

MORE CASH IN SAVINGS

RETIREMENT / ASSET LIQUIDITY

DOUBLES BUYING POWER

Compared to plan #1

#3 Traditional

30-year Fixed Loan

3 Mandatory payments for

30 years

3 More cash in savings, but

less money monthly due to

mortgage payments

*Borrower(s) must continue 3 Buying power dependent

to pay property taxes and on income

homeowner’s insurance,

maintain the home, and

otherwise comply with the

loan terms.

8