Page 9 - FOR Buyers Guide

P. 9

BUYER’S HANDBOOK - WHO PAYS FOR WHAT

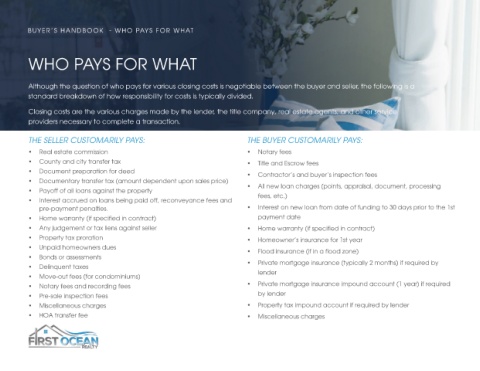

WHO PAYS FOR WHAT

Although the question of who pays for various closing costs is negotiable between the buyer and seller, the following is a

standard breakdown of how responsibility for costs is typically divided.

Closing costs are the various charges made by the lender, the title company, real estate agents, and other service

providers necessary to complete a transaction.

THE SELLER CUSTOMARILY PAYS: THE BUYER CUSTOMARILY PAYS:

• Real estate commission • Notary fees

• County and city transfer tax • Title and Escrow fees

• Document preparation for deed

• Contractor’s and buyer’s inspection fees

• Documentary transfer tax (amount dependent upon sales price)

• All new loan charges (points, appraisal, document, processing

• Payoff of all loans against the property

fees, etc.)

• Interest accrued on loans being paid off, reconveyance fees and

pre-payment penalties. • Interest on new loan from date of funding to 30 days prior to the 1st

• Home warranty (if specified in contract) payment date

• Any judgement or tax liens against seller • Home warranty (if specified in contract)

• Property tax proration • Homeowner’s insurance for 1st year

• Unpaid homeowners dues

• Flood insurance (if in a flood zone)

• Bonds or assessments

• Private mortgage insurance (typically 2 months) if required by

• Delinquent taxes

lender

• Move-out fees (for condominiums)

• Notary fees and recording fees • Private mortgage insurance impound account (1 year) if required

• Pre-sale inspection fees by lender

• Miscellaneous charges • Property tax impound account if required by lender

• HOA transfer fee • Miscellaneous charges