Page 5 - First Ocean Realty Home Seller's Guide Fall 2021

P. 5

4 MAJOR INCENTIVES TO SELL THIS FALL

4 MAJOR INCENTIVES TO SELL THIS FALL

...Continued

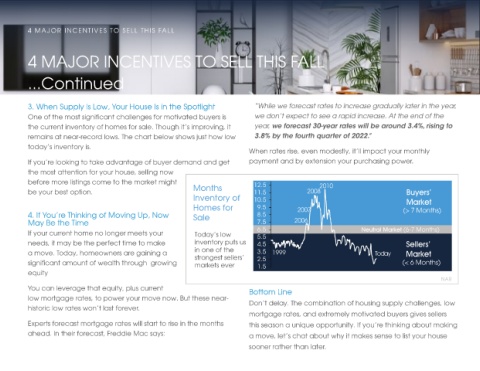

3. When Supply Is Low, Your House Is in the Spotlight “While we forecast rates to increase gradually later in the year,

One of the most significant challenges for motivated buyers is we don’t expect to see a rapid increase. At the end of the

the current inventory of homes for sale. Though it’s improving, it year, we forecast 30-year rates will be around 3.4%, rising to

remains at near-record lows. The chart below shows just how low 3.8% by the fourth quarter of 2022.”

today’s inventory is.

When rates rise, even modestly, it’ll impact your monthly

If you’re looking to take advantage of buyer demand and get payment and by extension your purchasing power.

the most attention for your house, selling now

before more listings come to the market might 12.5 2010

be your best option. Months 11.5 2008 Buyers’

Inventory of 10.5 Market

Homes for 9.5 2007 (> 7 Months)

4. If You’re Thinking of Moving Up, Now Sale 8.5

May Be the Time 7.5 2006

If your current home no longer meets your Today’s low 6.5 Neutral Market (6-7 Months)

5.5

needs, it may be the perfect time to make inventory puts us 4.5 Sellers’

a move. Today, homeowners are gaining a in one of the 3.5 1999 Today Market

strongest sellers’

significant amount of wealth through growing markets ever 2.5 (< 6 Months)

1.5

equity

NAR

You can leverage that equity, plus current Bottom Line

low mortgage rates, to power your move now. But these near- Don’t delay. The combination of housing supply challenges, low

historic low rates won’t last forever.

mortgage rates, and extremely motivated buyers gives sellers

Experts forecast mortgage rates will start to rise in the months this season a unique opportunity. If you’re thinking about making

ahead. In their forecast, Freddie Mac says: a move, let’s chat about why it makes sense to list your house

sooner rather than later.