Page 17 - November 2020 WCA Ketch Pen

P. 17

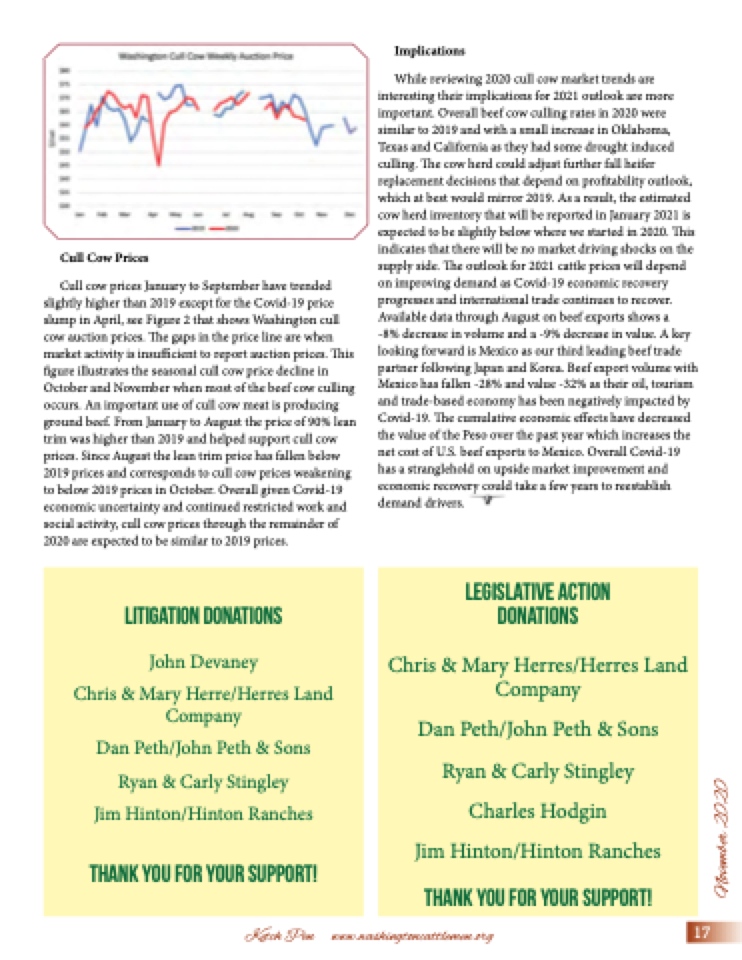

Cull Cow Prices

Cull cow prices January to September have trended slightly higher than 2019 except for the Covid-19 price slump in April, see Figure 2 that shows Washington cull cow auction prices. The gaps in the price line are when market activity is insufficient to report auction prices. This figure illustrates the seasonal cull cow price decline in October and November when most of the beef cow culling occurs. An important use of cull cow meat is producing ground beef. From January to August the price of 90% lean trim was higher than 2019 and helped support cull cow prices. Since August the lean trim price has fallen below 2019 prices and corresponds to cull cow prices weakening to below 2019 prices in October. Overall given Covid-19 economic uncertainty and continued restricted work and social activity, cull cow prices through the remainder of 2020 are expected to be similar to 2019 prices.

Implications

While reviewing 2020 cull cow market trends are interesting their implications for 2021 outlook are more important. Overall beef cow culling rates in 2020 were similar to 2019 and with a small increase in Oklahoma, Texas and California as they had some drought induced culling. The cow herd could adjust further fall heifer replacement decisions that depend on profitability outlook, which at best would mirror 2019. As a result, the estimated cow herd inventory that will be reported in January 2021 is expected to be slightly below where we started in 2020. This indicates that there will be no market driving shocks on the supply side. The outlook for 2021 cattle prices will depend on improving demand as Covid-19 economic recovery progresses and international trade continues to recover. Available data through August on beef exports shows a

-8% decrease in volume and a -9% decrease in value. A key looking forward is Mexico as our third leading beef trade partner following Japan and Korea. Beef export volume with Mexico has fallen -28% and value -32% as their oil, tourism and trade-based economy has been negatively impacted by Covid-19. The cumulative economic effects have decreased the value of the Peso over the past year which increases the net cost of U.S. beef exports to Mexico. Overall Covid-19 has a stranglehold on upside market improvement and economic recovery could take a few years to reestablish demand drivers.

Litigation donations

John Devaney

Chris & Mary Herre/Herres Land Company

Dan Peth/John Peth & Sons Ryan & Carly Stingley Jim Hinton/Hinton Ranches

Thank You for your support!

Legislative action donations

Chris & Mary Herres/Herres Land Company

Dan Peth/John Peth & Sons Ryan & Carly Stingley Charles Hodgin

Jim Hinton/Hinton Ranches

Thank You for your support!

Ketch Pen www.washingtoncattlemen.org

17

November 2020