Page 291 - Corporate Finance PDF Final new link

P. 291

NPP

BRILLIANT’S Investment Accounting 291

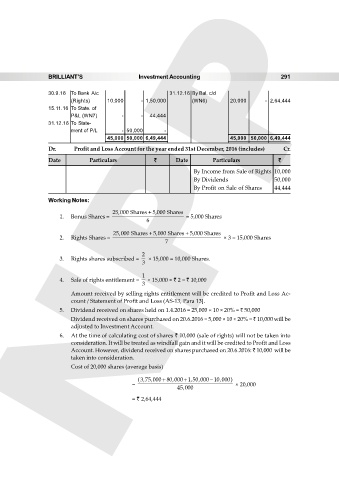

30.9.16 To Bank A/c 31.12.16 By Bal. c/d

(Rights) 10,000 - 1,50,000 (WN6) 20,000 - 2,64,444

15.11.16 To State. of

P&L (WN7) - - 44,444

31.12.16 To State-

ment of P/L - 50,000 -

45,000 50,000 6,49,444 45,000 50,000 6,49,444

Dr. Profit and Loss Account for the year ended 31st December, 2016 (includes) Cr.

Date Particulars ` Date Particulars `

By Income from Sale of Rights 10,000

By Dividends 50,000

By Profit on Sale of Shares 44,444

Working Notes:

25,000 Shares + 5,000 Shares

1. Bonus Shares = = 5,000 Shares

6

25,000 Shares + 5,000 Shares + 5,000 Shares

2. Rights Shares = × 3 = 15,000 Shares

7

2

3. Rights shares subscribed = × 15,000 = 10,000 Shares.

3

1

4. Sale of rights entitlement = × 15,000 × ` 2 = ` 10,000

3

Amount received by selling rights entitlement will be credited to Profit and Loss Ac-

count / Statement of Profit and Loss (AS-13, Para 13].

5. Dividend received on shares held on 1.4.2016 = 25,000 × 10 × 20% = ` 50,000

Dividend received on shares purchased on 20.6.2016 = 5,000 × 10 × 20% = ` 10,000 will be

adjusted to Investment Account.

6. At the time of calculating cost of shares ` 10,000 (sale of rights) will not be taken into

consideration. It will be treated as windfall gain and it will be credited to Profit and Loss

Account. However, dividend received on shares purchased on 20.6.2016: ` 10,000 will be

taken into consideration.

Cost of 20,000 shares (average basis)

3,75,000 80,000 1,50,000 10,000

= × 20,000

45,000

= ` 2,64,444