Page 352 - Corporate Finance PDF Final new link

P. 352

352 Corporate Finance BRILLIANT’S

also deductible from income before tax. There- BgH$m H$maU `h h¡ {H$ F$U na ã`mO H$s Xa Z {g\©$

fore, after tax, it will cost, only 7.5% if we as- g_Vm na Ano{jV àË`m` go H$_ h¡ ~pëH$ Bg na H$a H$m

sume tax rate 50%. This means average cost of àm°{’$Q> ^r {_bVm h¡Ÿ& `{X H$a H$s Xa 50% _mZ| Vmo F$U

` 1 lac would be only 10.9 (16% on ` 40,000 and na ã`mO H$s ewÕ bmJV {g\©$ 7.5% hr ah Om`oJrŸ& `{X

7.5% on ` 60,000). Thus, the weighted cost of ` 1 bmI na Am¡gV bmJV H$s JUZm H$a| Vmo dh _mÌ

capital of a firm can increase or decrease by 10.9% (` 40,000 na 16% d ` 60,000 na

change in debt-equity ratio. However, the debt- 7.5%) hmoJrŸ& AV… ñnï> h¡ {H$ ny§Or Ho$ {_lU _| n[adV©Z

equity can be increased only upto a certain go H$m°ñQ> Am°’$ H¡${nQ>b H$mo à^m{dV {H$`m Om gH$Vm h¡Ÿ&

limit because after that investors will consider `Ú{n S>oãQ> AWm©V² brdaoO H$mo EH$ gr_m VH$ hr ~‹T>m`m Om

the firm too risky and their expectations from gH$Vm h¡ Š`m|{H$ CgHo$ níMmV² Omo{I_ ~‹T>Zo Ho$ H$maU

equity shares of the company will go up. BÝdoñQ>g© H$m Ano{jV àË`m` ^r ~‹T> OmVm h¡Ÿ&

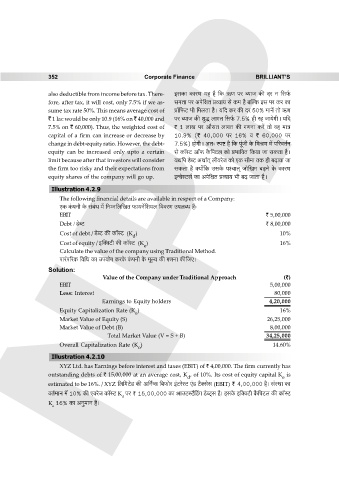

Illustration 4.2.9

The following financial details are available in respect of a Company:

EH$ H§$nZr Ho$ g§~§Y ‘| {ZåZ{b{IV ’$m¶Z|{e¶b {ddaU CnbãY h¢…

EBIT NPP ` 5,00,000

Debt / S>oãQ> ` 8,00,000

Cost of debt / S>oãQ> H$s H$m°ñQ> (K ) 10%

d

Cost of equity / Bp³dQ>r H$s H$m°ñQ> (K ) 16%

e

Calculate the value of the company using Traditional Method.

nma§n[aH$ {d{Y H$m Cn¶moJ H$aHo$ H§$nZr Ho$ ‘yë¶ H$s JUZm H$s{OE&

Solution:

Value of the Company under Traditional Approach (`)

EBIT 5,00,000

Less: Interest 80,000

Earnings to Equity holders 4,20,000

Equity Capitalization Rate (K ) 16%

e

Market Value of Equity (S) 26,25,000

Market Value of Debt (B) 8,00,000

Total Market Value (V = S + B) 34,25,000

Overall Capitalization Rate (K ) 14.60%

o

Illustration 4.2.10

XYZ Ltd. has Earnings before interest and taxes (EBIT) of ` 4,00,000. The firm currently has

outstanding debts of ` 15,00,000 at an average cost, K , of 10%. Its cost of equity capital K is

d e

estimated to be 16%. / XYZ {b{‘Q>oS> H$s A{Zª½g {~’$moa B§Q>aoñQ> E§S> Q>¡³gog (EBIT) < 4,00,000 h¡& g§ñWm H$m

dV©‘mZ ‘| 10% H$s EdaoO H$m°ñQ> K na < 15,00,000 H$m AmCQ>ñQ>¢qS>J S>oãQ²>g h¡& BgHo$ B{³dQ>r H¡${nQ>b H$s H$m°ñQ>

d

K 16% H$m AZw‘mZ h¡&

e