Page 420 - Corporate Finance PDF Final new link

P. 420

NPP

420 Corporate Finance BRILLIANT’S

10,00,000-80,000

`

`

+ 80,000 + 1,00,000 = ` 6,40,000

2

92,000

ARR = 100 = 14.38% (Approx.)

6,40,000

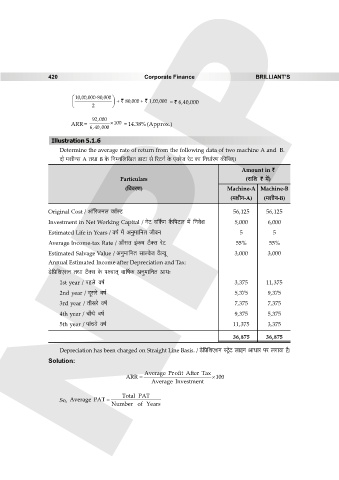

Illustration 5.1.6

Determine the average rate of return from the following data of two machine A and B.

Xmo ‘erÝg A VWm B Ho$ {ZåZ{b{IV S>mQ>m go [aQ>Z© Ho$ EdaoO aoQ> H$m {ZYm©aU H$s{OE&

Amount in `

Particulars (am{e ` ‘|)

({ddaU) Machine-A Machine-B

(‘erZ-A) (‘erZ-B)

Original Cost / Am°[aOZb H$m°ñQ> 56,125 56,125

Investment in Net Working Capital / ZoQ> d{Hª$J H¡${nQ>b ‘| {Zdoe 5,000 6,000

Estimated Life in Years / df© ‘| AZw‘m{ZV OrdZ 5 5

Average Income-tax Rate / Am¡gV B§H$‘ Q>¡³g aoQ> 55% 55%

Estimated Salvage Value / AZw‘m{ZV gmëdoO d¡ë¶y 3,000 3,000

Annual Estimated Income after Depreciation and Tax:

S>o{à{eEeZ VWm Q>¡³g Ho$ níMmV² dm{f©H$ AZw‘m{ZV Am¶…

1st year / nhbo df© 3,375 11,375

2nd year / Xÿgao df© 5,375 9,375

3rd year / Vrgao df© 7,375 7,375

4th year / Mm¡Wo df© 9,375 5,375

5th year / nm§Mdo df© 11,375 3,375

36,875 36,875

Depreciation has been charged on Straight Line Basis. / S>o{à{eEeZ ñQ´>oQ> bmBZ AmYma na bJm¶m h¡&

Solution:

Average Profit After Tax

ARR 100

Average Investment

Total PAT

So, Average PAT

Number of Years