Page 20 - NEW Armstrong Book - 2

P. 20

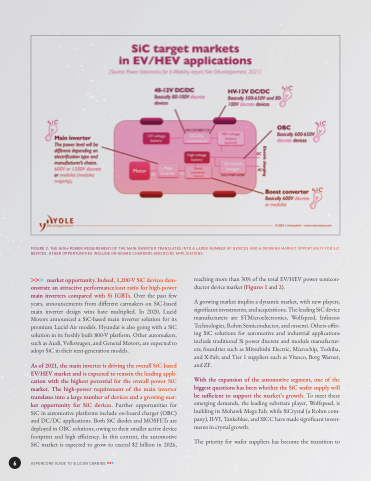

FIGURE 2: THE HIGH-POWER REQUIREMENT OF THE MAIN INVERTER TRANSLATES INTO A LARGE NUMBER OF DEVICES AND A GROWING MARKET OPPORTUNITY FOR SiC DEVICES. OTHER OPPORTUNITIES INCLUDE ON-BOARD CHARGERS AND DC/DC APPLICATIONS.

market opportunity. Indeed, 1,200-V SiC devices dem- onstrate an attractive performance/cost ratio for high-power main inverters compared with Si IGBTs. Over the past few years, announcements from different carmakers on SiC-based main inverter design wins have multiplied. In 2020, Lucid Motors announced a SiC-based main inverter solution for its premium Lucid Air models. Hyundai is also going with a SiC solution in its freshly built 800-V platform. Other automakers, such as Audi, Volkswagen, and General Motors, are expected to adopt SiC in their next-generation models.

As of 2021, the main inverter is driving the overall SiC-based EV/HEV market and is expected to remain the leading appli- cation with the highest potential for the overall power SiC market. The high-power requirement of the main inverter translates into a large number of devices and a growing mar- ket opportunity for SiC devices. Further opportunities for SiC in automotive platforms include on-board charger (OBC) and DC/DC applications. Both SiC diodes and MOSFETs are deployed in OBC solutions, owing to their smaller active device footprint and high efficiency. In this context, the automotive SiC market is expected to grow to exceed $2 billion in 2026,

reaching more than 30% of the total EV/HEV power semicon- ductor device market (Figures 1 and 2).

A growing market implies a dynamic market, with new players, significant investments, and acquisitions. The leading SiC device manufacturers are STMicroelectronics, Wolfspeed, Infineon Technologies, Rohm Semiconductor, and onsemi. Others offer- ing SiC solutions for automotive and industrial applications include traditional Si power discrete and module manufactur- ers; foundries such as Mitsubishi Electric, Microchip, Toshiba, and X-Fab; and Tier 1 suppliers such as Vitesco, Borg Warner, and ZF.

With the expansion of the automotive segment, one of the biggest questions has been whether the SiC wafer supply will be sufficient to support the market’s growth. To meet these emerging demands, the leading substrate player, Wolfspeed, is building its Mohawk Mega Fab, while SiCrystal (a Rohm com- pany), II-VI, Tankeblue, and SICC have made significant invest- ments in crystal growth.

The priority for wafer suppliers has become the transition to

6

ASPENCORE GUIDE TO SILICON CARBIDE