Page 35 - SACRAMENTO - CA - CFBPW ANNUAL CONFERENCE PACKAGE - 17-19 MAY 2024

P. 35

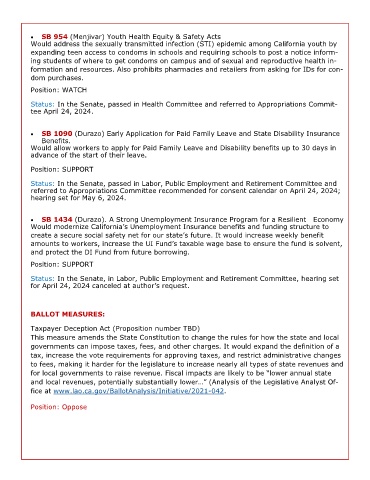

• SB 954 (Menjivar) Youth Health Equity & Safety Acts

Would address the sexually transmitted infection (STI) epidemic among California youth by

expanding teen access to condoms in schools and requiring schools to post a notice inform-

ing students of where to get condoms on campus and of sexual and reproductive health in-

formation and resources. Also prohibits pharmacies and retailers from asking for IDs for con-

dom purchases.

Position: WATCH

Status: In the Senate, passed in Health Committee and referred to Appropriations Commit-

tee April 24, 2024.

• SB 1090 (Durazo) Early Application for Paid Family Leave and State Disability Insurance

Benefits.

Would allow workers to apply for Paid Family Leave and Disability benefits up to 30 days in

advance of the start of their leave.

Position: SUPPORT

Status: In the Senate, passed in Labor, Public Employment and Retirement Committee and

referred to Appropriations Committee recommended for consent calendar on April 24, 2024;

hearing set for May 6, 2024.

• SB 1434 (Durazo). A Strong Unemployment Insurance Program for a Resilient Economy

Would modernize California’s Unemployment Insurance benefits and funding structure to

create a secure social safety net for our state’s future. It would increase weekly benefit

amounts to workers, increase the UI Fund’s taxable wage base to ensure the fund is solvent,

and protect the DI Fund from future borrowing.

Position: SUPPORT

Status: In the Senate, in Labor, Public Employment and Retirement Committee, hearing set

for April 24, 2024 canceled at author’s request.

BALLOT MEASURES:

Taxpayer Deception Act (Proposition number TBD)

This measure amends the State Constitution to change the rules for how the state and local

governments can impose taxes, fees, and other charges. It would expand the definition of a

tax, increase the vote requirements for approving taxes, and restrict administrative changes

to fees, making it harder for the legislature to increase nearly all types of state revenues and

for local governments to raise revenue. Fiscal impacts are likely to be “lower annual state

and local revenues, potentially substantially lower…” (Analysis of the Legislative Analyst Of-

fice at www.lao.ca.gov/BallotAnalysis/Initiative/2021-042.

Position: Oppose