Page 58 - The History of Watertown Savings Bank_Neat

P. 58

While the banking industry deregulations made While the WSB board of trustees debated

by Congress in the late 1970s and early 1980s had changing its corporate structure, the decision

opened the door for WSB to start offering many “We didn’t want to lose local was ultimately made to stay true to its mission of

new services to its customers, it had also created being a locally owned, locally operated bank to

another challenge for mutual savings banks control, and we didn’t want to benefit the community.

nationwide. “We didn’t want to lose local control, and we

The new laws resulted in increased competition become the target of a bigger didn’t want to become the target of a bigger bank,”

for deposit interest and home mortgage rates. Mr. Clark said. “We also looked at what we had

These changes were particularly difficult for bank. We also looked at what done for the community, and how other banks had

mutual savings banks, which had set caps on downsized their operations, or merged with larger

interest rates for deposits and loans. Many of their we had done for the community, ones. Some had moved out of the area, and people

depositors found higher returns at other banks. and how other banks had lost their jobs.”

The situation became known as the Savings &

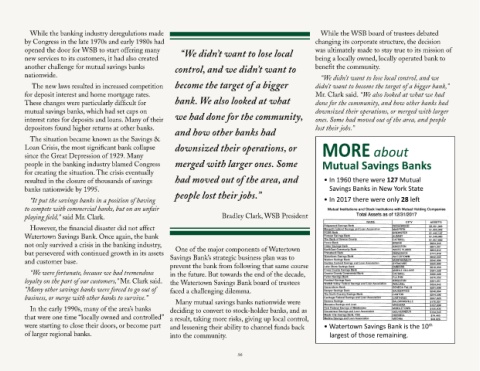

Loan Crisis, the most significant bank collapse downsized their operations, or MORE about

since the Great Depression of 1929. Many

people in the banking industry blamed Congress merged with larger ones. Some Mutual Savings Banks

for creating the situation. The crisis eventually

resulted in the closure of thousands of savings had moved out of the area, and • In 1960 there were 127 Mutual

banks nationwide by 1995. people lost their jobs.” Savings Banks in New York State

“It put the savings banks in a position of having • In 2017 there were only 28 left

to compete with commercial banks, but on an unfair

playing field,” said Mr. Clark. Bradley Clark, WSB President

However, the financial disaster did not affect

Watertown Savings Bank. Once again, the bank

not only survived a crisis in the banking industry,

but persevered with continued growth in its assets One of the major components of Watertown

and customer base. Savings Bank’s strategic business plan was to

prevent the bank from following that same course

“We were fortunate, because we had tremendous in the future. But towards the end of the decade,

loyalty on the part of our customers,” Mr. Clark said. the Watertown Savings Bank board of trustees

“Many other savings banks were forced to go out of faced a challenging dilemma.

business, or merge with other banks to survive.”

Many mutual savings banks nationwide were

In the early 1990s, many of the area’s banks deciding to convert to stock-holder banks, and as

that were one time “locally owned and controlled” a result, taking more risks, giving up local control,

were starting to close their doors, or become part and lessening their ability to channel funds back • Watertown Savings Bank is the 10

th

of larger regional banks. into the community. largest of those remaining.

56