Page 8 - Successor Trustee Handbook

P. 8

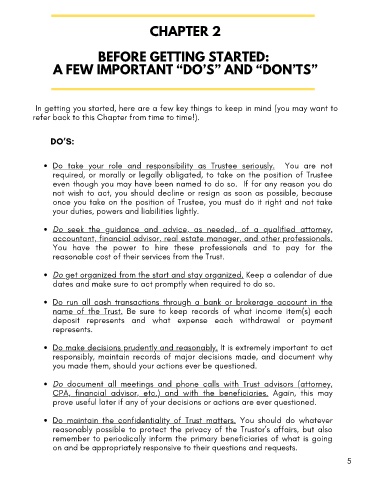

CHAPTER 2

BEFORE GETTING STARTED:

A FEW IMPORTANT “DO’S” AND “DON’TS”

In getting you started, here are a few key things to keep in mind (you may want to

refer back to this Chapter from time to time!).

DO’S:

Do take your role and responsibility as Trustee seriously. You are not

required, or morally or legally obligated, to take on the position of Trustee

even though you may have been named to do so. If for any reason you do

not wish to act, you should decline or resign as soon as possible, because

once you take on the position of Trustee, you must do it right and not take

your duties, powers and liabilities lightly.

Do seek the guidance and advice, as needed, of a qualified attorney,

accountant, financial advisor, real estate manager, and other professionals.

You have the power to hire these professionals and to pay for the

reasonable cost of their services from the Trust.

Do get organized from the start and stay organized. Keep a calendar of due

dates and make sure to act promptly when required to do so.

Do run all cash transactions through a bank or brokerage account in the

name of the Trust. Be sure to keep records of what income item(s) each

deposit represents and what expense each withdrawal or payment

represents.

Do make decisions prudently and reasonably. It is extremely important to act

responsibly, maintain records of major decisions made, and document why

you made them, should your actions ever be questioned.

Do document all meetings and phone calls with Trust advisors (attorney,

CPA, financial advisor, etc.) and with the beneficiaries. Again, this may

prove useful later if any of your decisions or actions are ever questioned.

Do maintain the confidentiality of Trust matters. You should do whatever

reasonably possible to protect the privacy of the Trustor’s affairs, but also

remember to periodically inform the primary beneficiaries of what is going

on and be appropriately responsive to their questions and requests.

5