Page 219 - Amata-one-report2020-en

P. 219

BUSINESS OPERATION AND OPERATING RESULTS CORPORATE GOVERNANCE FINANCIAL STATEMENTS ENCLOSURES

Foreign currency risk

The subsidiaries’ exposure to foreign currency risk is considered to be low since the majority

of their business transactions are denominated in local currency. As at 31 December 2020,

a subsidiary in Thailand has balance of deposits amounting to VND 601 million (2019: VND

606 million), and a subsidiary in Vietnam has balance of long-term loans in foreign currency

amounting to Baht 1,492 million (2019: balance of deposit and long-term loans amounting to

USD 1 million and Baht 1,589 million, respectively).

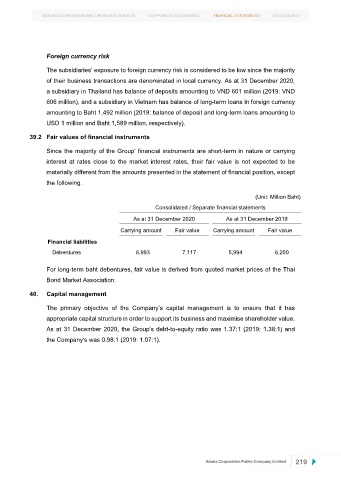

39.2 Fair values of financial instruments

Since the majority of the Group’ financial instruments are short-term in nature or carrying

interest at rates close to the market interest rates, their fair value is not expected to be

materially different from the amounts presented in the statement of financial position, except

the following.

(Unit: Million Baht)

Consolidated / Separate financial statements

As at 31 December 2020 As at 31 December 2019

Carrying amount Fair value Carrying amount Fair value

Financial liabilities

Debentures 6,993 7,117 5,994 6,200

For long-term baht debentures, fair value is derived from quoted market prices of the Thai

Bond Market Association.

40. Capital management

The primary objective of the Company’s capital management is to ensure that it has

appropriate capital structure in order to support its business and maximise shareholder value.

As at 31 December 2020, the Group's debt-to-equity ratio was 1.37:1 (2019: 1.38:1) and

the Company's was 0.98:1 (2019: 1.07:1).

Amata Corporation Public Company Limited 66 219