Page 33 - Consumer Mathematics

P. 33

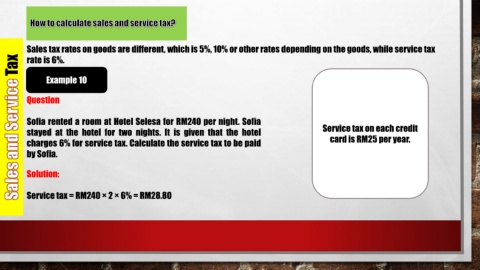

Sales tax rates on goods are different, which is 5%, 10% or other rates depending on the goods, while service tax

Tax rate is 6%.

Example 10

Question

Sofia rented a room at Hotel Selesa for RM240 per night. Sofia

stayed at the hotel for two nights. It is given that the hotel Service tax on each credit

charges 6% for service tax. Calculate the service tax to be paid card is RM25 per year.

by Sofia.

Solution:

Service tax = RM240 × 2 × 6% = RM28.80