Page 29 - 2021 Proxy Statement (03.10.2021 Draft)_Neat

P. 29

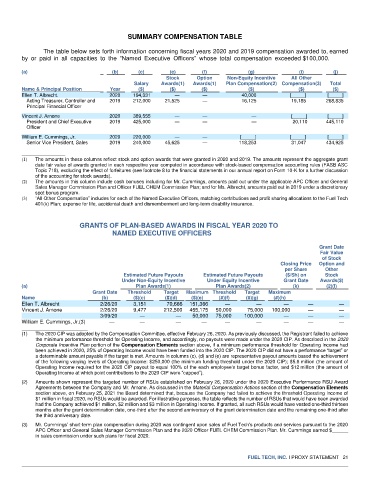

SUMMARY COMPENSATION TABLE

The table below sets forth information concerning fiscal years 2020 and 2019 compensation awarded to, earned

by or paid in all capacities to the “Named Executive Officers” whose total compensation exceeded $100,000.

(a) (b) (c) (e) (f) (g) (i) (j)

Stock Option Non-Equity Incentive All Other

Salary Awards(1) Awards(1) Plan Compensation(2) Compensation(3) Total

Name & Principal Position Year ($) ($) ($) ($) ($) ($)

Ellen T. Albrecht. 2020 194,331 — — 40,000 [_____] [_____]

Acting Treasurer, Controller and 2019 212,000 21,525 — 16,125 19,185 268,835

Principal Financial Officer

Vincent J. Arnone 2020 389,555 — — — [_____] [_____]

President and Chief Executive 2019 425,000 — — — 20,110 445,110

Officer

William E. Cummings, Jr. 2020 220,000 — — [_____] [_____] [_____]

Senior Vice President, Sales 2019 240,000 45,625 — 118,253 31,047 434,925

(1) The amounts in these columns reflect stock and option awards that were granted in 2020 and 2019. The amounts represent the aggregate grant

date fair value of awards granted in each respective year computed in accordance with stock-based compensation accounting rules (FASB ASC

Topic 718), excluding the effect of forfeitures (see footnote 8 to the financial statements in our annual report on Form 10-K for a further discussion

of the accounting for stock awards).

(2) The amounts in this column include cash bonuses including for Mr. Cummings, amounts paid out under the applicable APC Officer and General

Sales Manager Commission Plan and Officer FUEL CHEM Commission Plan; and for Ms. Albrecht, amounts paid out in 2019 under a discretionary

spot bonus program.

(3) “All Other Compensation” includes for each of the Named Executive Officers, matching contributions and profit sharing allocations to the Fuel Tech

401(k) Plan; expense for life, accidental death and dismemberment and long-term disability insurance.

GRANTS OF PLAN-BASED AWARDS IN FISCAL YEAR 2020 TO

NAMED EXECUTIVE OFFICERS

Grant Date

Fair Value

of Stock

Closing Price Option and

per Share Other

Estimated Future Payouts Estimated Future Payouts ($/Sh) on Stock

Under Non-Equity Incentive Under Equity Incentive Grant Date Awards($)

(a) Plan Awards(1) Plan Awards(2) (k) (2)(l)

Grant Date Threshold Target Maximum Threshold Target Maximum

Name (b) ($)(c) ($)(d) ($)(e) (#)(f) (#)(g) (#)(h)

Ellen T. Albrecht 2/26/20 3,151 70,666 151,366 — — — — —

Vincent J. Arnone 2/26/20 9,477 212,500 455,175 50,000 75,000 100,000 — —

3/09/20 — — 50,000 75,000 100,000 — — —

William E. Cummings, Jr.(3) — — — — — — — — —

(1) The 2020 CIP was adopted by the Compensation Committee, effective February 26, 2020. As previously discussed, the Registrant failed to achieve

the minimum performance threshold for Operating Income, and accordingly, no payouts were made under the 2020 CIP. As described in the 2020

Corporate Incentive Plan portion of the Compensation Elements section above, if a minimum performance threshold for Operating Income had

been achieved in 2020, 25% of Operating Income would have been funded into the 2020 CIP. The 2020 CIP did not have a performance “target” or

a determinable amount payable if the target is met. Amounts in columns (c), (d) and (e) are representative payout amounts based the achievement

of the following varying levels of Operating Income: $250,000 (the minimum funding threshold under the 2020 CIP); $5.6 million (the amount of

Operating Income required for the 2020 CIP payout to equal 100% of the each employee’s target bonus factor, and $12 million (the amount of

Operating Income at which point contributions to the 2020 CIP were “capped”).

(2) Amounts shown represent the targeted number of RSUs established on February 26, 2020 under the 2020 Executive Performance RSU Award

Agreements between the Company and Mr. Arnone. As discussed in the Material Compensation Actions section of the Compensation Elements

section above, on February 25, 2021 the Board determined that, because the Company had failed to achieve the threshold Operating Income of

$1 million in fiscal 2020, no RSUs would be awarded. For illustrative purposes, the table reflects the number of RSUs that would have been awarded

had the Company achieved $1 million, $2 million and $3 million in Operating Income. If granted, all such RSUs would have vested one-third thirteen

months after the grant determination date, one-third after the second anniversary of the grant determination date and the remaining one-third after

the third anniversary date.

(3) Mr. Cummings’ short-term plan compensation during 2020 was contingent upon sales of Fuel Tech’s products and services pursuant to the 2020

APC Officer and General Sales Manager Commission Plan and the 2020 Officer FUEL CHEM Commission Plan. Mr. Cummings earned $______

in sales commission under such plans for fiscal 2020.

FUEL TECH, INC. l PROXY STATEMENT 21