Page 11 - CNB Bank Shares 2018 Annual Report

P. 11

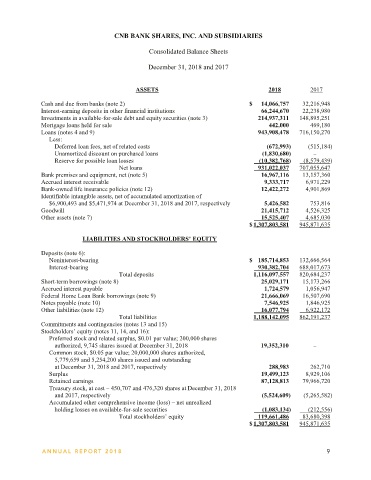

CNB BANK SHARES, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

December 31, 2018 and 2017

Independent Auditors’ Report ASSETS 2018 2017

Cash and due from banks (note 2) $ 14,066,757 32,216,948

Interest-earning deposits in other financial institutions 66,244,670 22,238,980

The Board of Directors Investments in available-for-sale debt and equity securities (note 3) 214,937,311 148,895,251

CNB Bank Shares, Inc.: Mortgage loans held for sale 442,000 469,180

Loans (notes 4 and 9) 943,908,478 716,150,270

Report on the Consolidated Financial Statements Less:

Deferred loan fees, net of related costs (672,993) (515,184)

We have audited the accompanying consolidated financial statements of CNB Bank Shares, Inc. and subsidiaries, Unamortized discount on purchased loans (1,830,680) −

which comprise the consolidated balance sheets as of December 31, 2018 and 2017, and the related consolidated Reserve for possible loan losses (10,382,768) (8,579,439)

statements of income, comprehensive income, stockholders’ equity, and cash flows for the years then ended, and the Net loans 931,022,037 707,055,647

related notes to the consolidated financial statements. Bank premises and equipment, net (note 5) 16,967,116 13,157,360

Accrued interest receivable 9,333,717 6,971,229

Management’s Responsibility for the Consolidated Financial Statements Bank-owned life insurance policies (note 12) 12,422,272 4,901,869

Identifiable intangible assets, net of accumulated amortization of

Management is responsible for the preparation and fair presentation of these consolidated financial statements in $6,900,493 and $5,471,974 at December 31, 2018 and 2017, respectively 5,426,582 753,816

accordance with accounting principles generally accepted in the United States of America; this includes the design, Goodwill 21,415,712 4,526,325

implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated Other assets (note 7) 15,525,407 4,685,030

financial statements that are free from material misstatement, whether due to fraud or error. $ 1,307,803,581 945,871,635

Auditor’s Responsibility

LIABILITIES AND STOCKHOLDERS’ EQUITY

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We

conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those Deposits (note 6):

standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated Noninterest-bearing $ 185,714,853 132,666,564

financial statements are free from material misstatement. Interest-bearing 930,382,704 688,017,673

Total deposits 1,116,097,557 820,684,237

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the Short-term borrowings (note 8) 25,029,171 15,173,266

consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the Accrued interest payable 1,724,579 1,056,947

assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or Federal Home Loan Bank borrowings (note 9) 21,666,069 16,507,690

error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and Notes payable (note 10) 7,546,925 1,846,925

fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the Other liabilities (note 12) 16,077,794 6,922,172

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Total liabilities 1,188,142,095 862,191,237

Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies Commitments and contingencies (notes 13 and 15)

used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall Stockholders’ equity (notes 11, 14, and 16):

presentation of the consolidated financial statements. Preferred stock and related surplus, $0.01 par value; 200,000 shares

authorized, 9,745 shares issued at December 31, 2018 19,352,310 −

We believe that the audit evidence we obtained is sufficient and appropriate to provide a basis for our audit opinion. Common stock, $0.05 par value; 20,000,000 shares authorized,

5,779,659 and 5,254,200 shares issued and outstanding

Opinion at December 31, 2018 and 2017, respectively 288,983 262,710

Surplus 19,499,123 8,929,106

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the Retained earnings 87,128,813 79,966,720

financial position of CNB Bank Shares, Inc. and subsidiaries as of December 31, 2018 and 2017, and the results of Treasury stock, at cost – 450,707 and 476,320 shares at December 31, 2018

their operations and their cash flows for the years then ended in accordance with accounting principles generally and 2017, respectively (5,524,609) (5,265,582)

accepted in the United States of America. Accumulated other comprehensive income (loss) – net unrealized

holding losses on available-for-sale securities (1,083,134) (212,556)

Total stockholders’ equity 119,661,486 83,680,398

$ 1,307,803,581 945,871,635

St. Louis, Missouri See accompanying notes to consolidated financial statements.

February 19, 2019 ANNUAL REPOR T 2018 9