Page 9 - Internal Auditor M.E. - June 2019

P. 9

Knowledge Update

Internal Audit’s Role in Fraud Risk

Management

Internal auditors have always had potential for the occurrence of fraud,

a role to play in the detection and and examining how the organization

prevention of fraud. Whilst, some manages fraud risk through

internal auditors may investigate

fraud, organizations should not independent risk assessment and audit

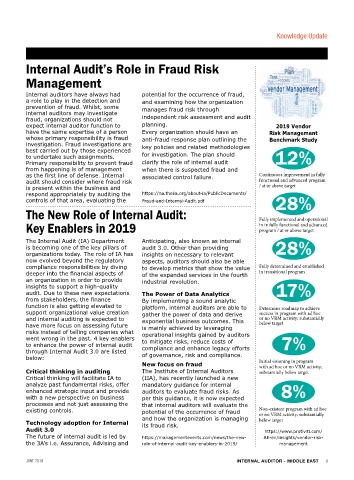

expect internal auditor function to planning. 2019 Vendor

have the same expertise of a person Every organization should have an Risk Management

whose primary responsibility is fraud anti-fraud response plan outlining the Benchmark Study

investigation. Fraud investigations are key policies and related methodologies

best carried out by those experienced

to undertake such assignments. for investigation. The plan should 12%

Primary responsibility to prevent fraud clarify the role of internal audit

from happening is of management when there is suspected fraud and

as the first line of defense. Internal associated control failure. Continuous improvement in fully

audit should consider where fraud risk functional and advanced program

is present within the business and / at or above target

respond appropriately by auditing the https://na.theiia.org/about-ia/PublicDocuments/

controls of that area, evaluating the Fraud-and-Internal-Audit.pdf 28%

The New Role of Internal Audit: Fully implemented and operational

Key Enablers in 2019 in in fully functional and advanced

program / at or above target

The Internal Audit (IA) Department Anticipating, also known as internal

is becoming one of the key pillars of audit 3.0. Other than providing 28%

organizations today. The role of IA has insights on necessary to relevant

now evolved beyond the regulatory aspects, auditors should also be able

compliance responsibilities by diving to develop metrics that show the value Fully determined and established

deeper into the financial aspects of of the expanded services in the fourth in transitional program

an organization in order to provide industrial revolution.

insights to support a high-quality 17%

audit. Due to these new expectations The Power of Data Analytics

from stakeholders, the finance By implementing a sound analytic

function is also getting elevated to platform, internal auditors are able to Determine roadmap to achieve

support organizational value creation gather the power of data and derive success in program with ad hoc

and internal auditing is expected to exponential business outcomes. This or no VRM activity; substantially

have more focus on assessing future is mainly achieved by leveraging below target

risks instead of telling companies what operational insights gained by auditors

went wrong in the past. 4 key enablers to mitigate risks, reduce costs of

to enhance the power of internal audit 7%

through Internal Audit 3.0 are listed compliance and enhance legacy efforts

below: of governance, risk and compliance.

New focus on fraud Initial visioning in program

with ad hoc or no VRM activity;

Critical thinking in auditing The Institute of Internal Auditors substantially below target

Critical thinking will facilitate IA to (IIA), has recently launched a new

analyze past fundamental risks, offer mandatory guidance for internal

enhanced strategic input and provide auditors to evaluate fraud risks. As 8%

with a new perspective on business per this guidance, it is now expected

processes and not just assessing the that internal auditors will evaluate the

existing controls. potential of the occurrence of fraud Non-existent program with ad hoc

and how the organization is managing or no VRM activity; substantially

below target

Technology adoption for Internal its fraud risk.

Audit 3.0 https://www.protiviti.com/

The future of internal audit is led by https://managementevents.com/news/the-new- AE-en/insights/vendor-risk-

the 3A’s i.e. Assurance, Advising and role-of-internal-audit-key-enablers-in-2019/ management

JUNE 2019 INTERNAL AUDITOR - MIDDLE EAST 9