Page 38 - P4304.1-V90_PS-Magazine-October 2023 - PRINT

P. 38

PAs....... Revisited!

By Caroline Pond.

WOW! I have had so many questions the VAT on the item to compensate for VAT

and queries after my article on which cannot be claimed because the item

PAs in June, I thought it might be has been used in the practice rather than

being dispensed to the patient to take home

useful to go over things again. I fully and use.

appreciate this is a tricky subject You must understand this point before we go

to understand so no harm in going any further.

through some of the questions I A PA ITEM IS PREDEFINED AND

have been asked to try and clear up THE PA ALLOWANCE WILL BE PAID

any grey areas. AUTOMATICALLY ON ALL ITEMS TAGGED BY

THE NHSBSA. YOU DO NOT NEED TO CLAIM.

First clarification; please all understand

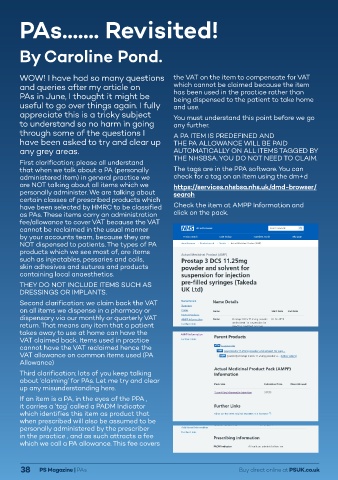

that when we talk about a PA (personally The tags are in the PPA software. You can

administered item) in general practice we check for a tag on an item using the dm+d

are NOT talking about all items which we https://services.nhsbsa.nhs.uk/dmd-browser/

personally administer. We are talking about search

certain classes of prescribed products which

have been selected by HMRC to be classified Check the item at AMPP Information and

as PAs. These items carry an administration click on the pack.

fee/allowance to cover VAT because the VAT

cannot be reclaimed in the usual manner

by your accounts team, because they are

NOT dispensed to patients. The types of PA

products which we see most of, are items

such as injectables, pessaries and coils,

skin adhesives and sutures and products

containing local anaesthetics.

THEY DO NOT INCLUDE ITEMS SUCH AS

DRESSINGS OR IMPLANTS.

Second clarification; we claim back the VAT

on all items we dispense in a pharmacy or

dispensary via our monthly or quarterly VAT

return. That means any item that a patient

takes away to use at home can have the

VAT claimed back. Items used in practice

cannot have the VAT reclaimed hence the

VAT allowance on common items used (PA

Allowance)

Third clarification; lots of you keep talking

about ‘claiming’ for PAs. Let me try and clear

up any misunderstanding here.

If an item is a PA, in the eyes of the PPA ,

it carries a ‘tag’ called a PADM Indicator

which identifies this item as product that

when prescribed will also be assumed to be

personally administered by the prescriber

in the practice , and as such attracts a fee

which we call a PA allowance. This fee covers

38 PS Magazine | PAs Buy direct online at PSUK.co.uk

06/09/2023 16:25:13

P4304.1-V90_PS-Magazine-October 2023.indd 38 06/09/2023 16:25:13

P4304.1-V90_PS-Magazine-October 2023.indd 38