Page 107 - مجلة المحكمة العليا السنة الأولى العدد الأول

P. 107

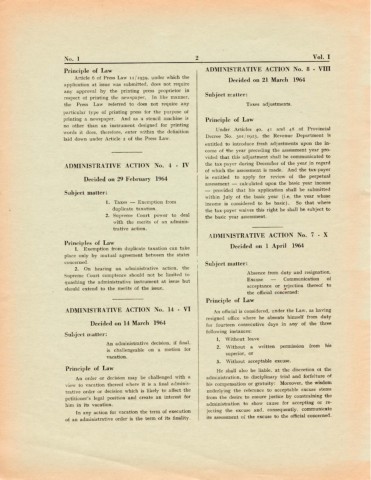

No. 1 2 Vol. I

Principle of Law ADMINISTRATIVE ACTION No. 8 - VIII

Article 6 of Press Law 11/1959, under which the Decided on 21 March 1964

application at issue was submitted, does not require

any approval by the printing press proprietor in Subject matter:

respect of printing the newspaper, In like manner,

the Press Law referred to does not require any Taxes adjustments.

particular type of printing press for the purpose of Principle of Law

printing a newspaper. And as a stencil machine is

no other than an instrument designed for printing Under Articles 40, 41 and 48 of Provincial

words it does, therefore, enter within the definition Decree No. 501/1923, the Revenue Department is

laid down under Article 2 of the Press Law. entitled to introduce fresh adjustments upon the in-

come of the year preceding the assessment year pro-

ADMINISTRATIVE ACTION No. 4 - IV vided that this adjustment shall be communicated to

the tax-payer during December of the year in regard

Decided on 29 February 1964 of which the assessment is made. And the tax-payer

is entitled to apply for review of the perpetual

Subject matter: assessment - calculated upon the basic year income

- provided that his application shall be submitted

1. Taxes - Exemption from within July of the basic year (i.e. the year whose

duplicate taxation. income is considered to be basic). So that where

the tax-payer waives this right he shall be subject to

2. Supreme Court power to deal the basic year assessment.

with the merits of an adminis-

trative action. ADMINISTRATIVE ACTION No. 7 • X

Decided on 1 April 1964

Principles of Law

Subject matter:

l. Exemption from duplicate taxation can take

place only by mutual agreement between the states Absence from duty and resignation.

concerned.

Excuse Communication of

2. On hearing an administrative action, the

Supreme Court comptence should not be limited to acceptance or rejection thereof to

quashing the administrative instrument at issue but

should extend to the merits of the issue. the official concerned:

ADMINISTRATIVE ACTION No. 14 - VI Principle of Law

Decided on 14 March 1964 An official is considered, under the Law, as having

resigned office where he absents himself from duty

Subject matter: for fourteen consecutive days in any of the three

following instances:

An administrative decision, if final,

is challengeable on a motion for l. Without leave

vacation.

2. Without a written permission from his

Principle of Law superior, or

An order or decision may be challenged with a 3. Without acceptable excuse.

view to vacation thereof where it is a final adminis-

trative order or decision which is likely to affect the He shall also be liable, at the discretion ot the

petitioner's legal position and create an interest for administration, to disciplinary trial and forfeiture of

him in its vacation. his compensation or gratuity: Moreover, the wisdom

underlying the reference to acceptable excuse sterns

In any action for vacation the term of execution from the desire to ensure justice by constraining the

of an administrative order is the term of its finality. administration to show cause for accepting or re-

jecting the excuse and, consequently, communicate

its assessment oi the excuse to the official concerned.