Page 3 - RR Donnelley - Market Overview

P. 3

UPTOWN/TURTLE CREEK MARKET OVERVIEW

• Demand from tenants moving to newer, higher-quality space in this Current Quarter YoY Change

walkable submarket has driven net absorption this cycle. The Union, a

highly-amenitized development, welcomed over 200,000 SF of tenants in Inventory 12,576,649

2019 including Salesforce. Newly delivered Harwood No. 10 saw 81,000 SF % of Total Market 5.6%

of move-ins in Q3 and Q4 2019.

Direct Vacant % 11.9% q

• Increasing operating expenses have caused significant jumps in overall Total Vacant % 13.1% q

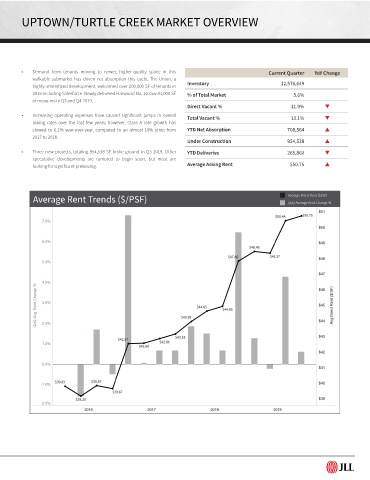

asking rates over the last few years; however, Class A rate growth has

slowed to 6.1% year-over-year, compared to an almost 10% jump from YTD Net Absorption 708,564

2017 to 2018.

Under Construction 954,538

• Three new projects, totaling 954,538 SF broke ground in Q3 2019. Other YTD Deliveries 265,860 q

speculative developments are rumored to begin soon, but most are

looking for significant preleasing. Average Asking Rent $50.75

Average Rent Trends ($/PSF) Average Direct Rent ($/SF)

QoQ Average Rent Change %