Page 5 - Michael Baker - Market Overview - 02-2020

P. 5

MARKET OVERVIEW

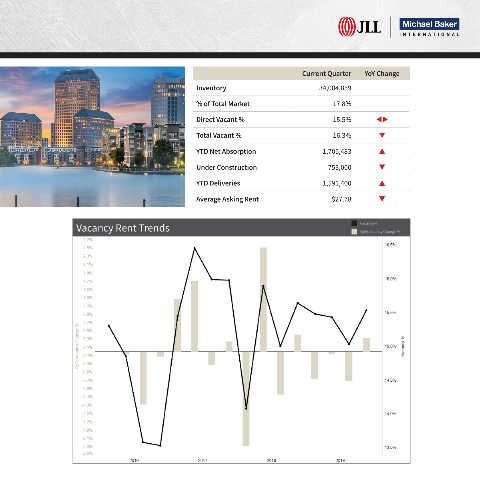

• West LBJ/Las Colinas continues to be a preferred office hub due Current Quarter YoY Change

to the presence of a diverse lineup of major corporations, its

strong regional access, and perceived value compared to other Inventory 34,004,859

competitive submarkets. % of Total Market 17.8%

• Relatively low vacancy and steady demand has continued to Direct Vacant % 15.5% tu

drive rents in this desirable submarket. Class A Buildings in this Total Vacant % 16.3% q

market are switching to triple net rates as operating expenses rise,

contributing to higher overall asking rates. YTD Net Absorption 1,705,483

Under Construction 753,000 q

• The completion of Pioneer Natural Resources’ 1.1 million square

foot campus at Hidden Ridge was a significant factor in 2019’s YTD Deliveries 1,591,400

net absorption and new supply. While Pioneer vacated space at

Williams Tower, the move was a net-gain for the submarket. Average Asking Rent $27.78 q

Average Rent Trends ($/PSF) Average Direct Rent ($/SF) Vacancy Rent Trends Vacancy %

QoQ Average Rent Change %

QoQ Vacancy Change %