Page 4 - JLL Introduction/Submarket Overview

P. 4

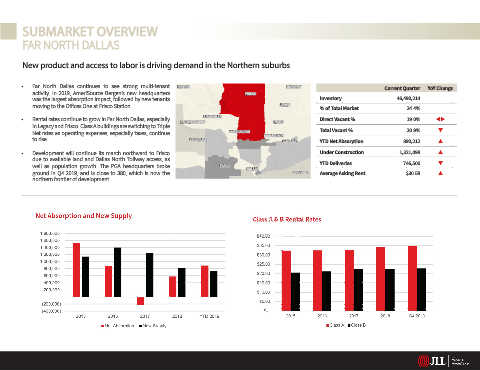

Far North Dallas

New product, access to labor

driving demand in northern

Net Absorption and New Supply

suburbs

1,500,000

Far North Dallas continues to see strong multi-tenant activity.

•

1,000,000

In Q3 2019, the North Building of Fourteen555 saw two large 2,000,000 Q3 2019 Submarket Overview

move-ins from Moss Adams (35k) and Common Desk (27k).

500,000

• Rental rates continue to grow in Far North Dallas, especially

SUBMARKET OVERVIEW in Legacy and Frisco. Class A buildings are switching to Triple -

Net rates as operating expenses, especially taxes, continue to

FAR NORTH DALLAS • rise. (500,000) 2015 2016 2017 2018 Q3 2019

Development will continue its march northward to Frisco due

to available land and Dallas North Tollway access, as well as Net Absorption New Supply

population growth. Two projects -- The Offices Two at Frisco

New product and access to labor is driving demand in the Northern suburbs Total Vacancy

Station and the Offices at The Realm is expected to deliver

later this year adding over 450,000 SF of inventory.

25.0%

• Far North Dallas continues to see strong multi-tenant DENTON McKINNEY Current Quarter YoY Change

McKINNEY

DENTON

activity. In 2019, AmeriSource Bergen’s new headquarters FRISCO 20.0%

FRISCO

was the largest absorption impact, followed by new tenants Inventory 46,490,214

15.0%

moving to the Offices One at Frisco Station. ALLEN % of Total Market 24.4%

ALLEN

10.0%

LEWISVILLE

• Rental rates continue to grow in Far North Dallas, especially LEWISVILLE Direct Vacant % 19.0% tu

PLANO

FLOWER MOUND

in Legacy and Frisco. Class A buildings are switching to Triple FLOWER MOUND PLANO 5.0%

Net rates as operating expenses, especially taxes, continue CARROLLTON Total Vacant % 20.9% q

CARROLLTON

RICHARDSON

to rise. GRAPEVINE RICHARDSON GARLAND YTD Net Absorption 890,212

GRAPEVINE

0.0%

GARLAND

2015 2016 2017 2018 Q3 2019

1,321,098

• Development will continue its march northward to Frisco Under Construction Far North Dallas Total Vacancy DFW Total Vacancy

due to available land and Dallas North Tollway access, as

well as population growth. The PGA headquarters broke IRVING YTD Deliveries 746,500 q

IRVING

Class A & B Rental Rates

DALLAS

ground in Q4 2019, and is close to 380, which is now the DALLAS MESQUITE Average Asking Rent $30.58

FORT WORTH

FORT WORTH

MESQUITE

northern frontier of development. $40.00

Current Quarter YoY Change

$35.00

Inventory 46,035,272

$30.00

% of Total Market 20.9%

$25.00

Direct Vacant % 19.2% p

$20.00

Total Vacant % 21.1% p

$15.00

YTD Net Absorption 438,167 p $10.00

Under Construction 1,133,954 p $5.00

YTD Deliveries 300,000 q $-

Average Asking Rent $30.92 p 2015 2016 2017 2018 Q3 2019

Class A Class B

Derith Jarvis Walter Bialas Kari Beets

Senior Vice President, Research Vice President, Research Manager, Research

+1 214 438 6464 +1 214 438 6228 +1 214 438 1553

derith.jarvis@am.jll.com walter.bialas@am.jll.com kari.beets@am.jll.com

© 2019 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof.