Page 9 - FIRPTA Guide AZ

P. 9

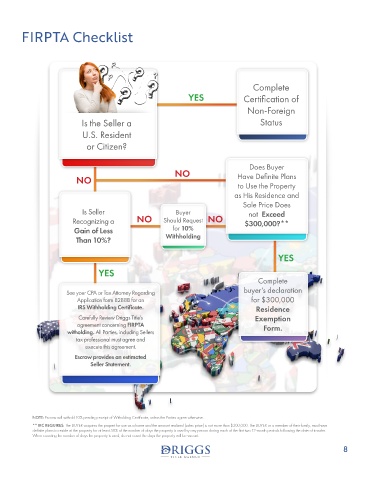

FIRPTA Checklist

Complete

YES Certification of

Non-Foreign

Is the Seller a Status

U.S. Resident

or Citizen?

Does Buyer

NO Have Definite Plans

NO

to Use the Property

as His Residence and

Sale Price Does

Is Seller Buyer not Exceed

Recognizing a NO Should Request NO $300,000?**

Gain of Less for 10%

Than 10%? Withholding

YES

YES

Complete

See your CPA or Tax Attorney Regarding buyer’s declaration

Application form 8288B for an for $300,000

IRS Withholding Certificate. Residence

Carefully Review Driggs Title’s Exemption

agreement concerning FIRPTA Form.

witholding. All Parties, including Sellers

tax professional must agree and

execute this agreement.

Escrow provides an estimated

Seller Statement.

NOTE: Escrow will withold 10% pending receipt of Witholding Certificate, unless the Parties agree otherwise.

** IRC REQUIRES: The BUYER acquires the propert for use as a home and the amount realized (sales price) is not more than $300,000. The BUYER or a member of their family, must have

definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

When counting the number of days the property is used, do not count the days the property will be vacant.

8