Page 13 - Staci_Bawden_Buyer_Guide

P. 13

Arizona’s Good Funds Law

ARS 6-834 requires that “escrow agents not disburse money from an escrow account until funds related to the transaction

have been deposited and available.” The legislation specifies which forms of payments are acceptable for deposit.

All available dates are based on funds deposited in our bank, and the days are considered business days. A business day

is defined as a calendar day other than Saturday or Sunday, and also excluding most major holidays.

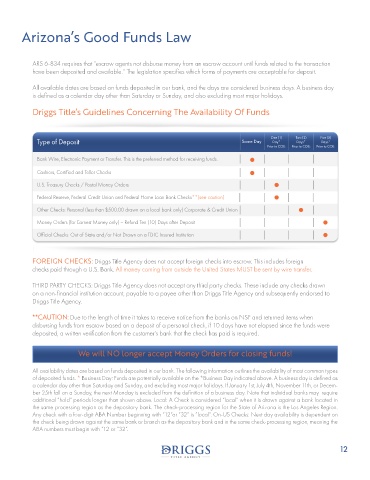

Driggs Title’s Guidelines Concerning The Availability Of Funds

One (1) Two (2) Five (5)

Type of Deposit Same Day Day* Days* Days*

Prior to COE: Prior to COE: Prior to COE:

Bank Wire, Electronic Payment or Transfer. This is the preferred method for receiving funds.

Cashiers, Certified and Teller Checks

U.S. Treasury Checks / Postal Money Orders

Federal Reserve, Federal Credit Union and Federal Home Loan Bank Checks**(see caution)

Other Checks: Personal (less than $500.00 drawn on a local bank only) Corporate & Credit Union

Money Orders (for Earnest Money only) – Refund Ten (10) Days after Deposit

Official Checks: Out of State and/or Not Drawn on a FDIC Insured Institution

FOREIGN CHECKS: Driggs Title Agency does not accept foreign checks into escrow. This includes foreign

checks paid through a U.S. Bank. All money coming from outside the United States MUST be sent by wire transfer.

THIRD PARTY CHECKS: Driggs Title Agency does not accept any third party checks. These include any checks drawn

on a non-financial institution account, payable to a payee other than Driggs Title Agency and subsequently endorsed to

Driggs Title Agency.

**CAUTION: Due to the length of time it takes to receive notice from the banks on NSF and returned items when

disbursing funds from escrow based on a deposit of a personal check, if 10 days have not elapsed since the funds were

deposited, a written verification from the customer’s bank that the check has paid is required.

We will NO longer accept Money Orders for closing funds!

All availability dates are based on funds deposited in our bank. The following information outlines the availability of most common types

of deposited funds. * Business Day: Funds are potentially available on the *Business Day indicated above. A business day is defined as

a calendar day other than Saturday and Sunday, and excluding most major holidays. If January 1st, July 4th, November 11th, or Decem-

ber 25th fall on a Sunday, the next Monday is excluded from the definition of a business day. Note that individual banks may require

additional “hold” periods longer than shown above. Local: A Check is considered “local” when it is drawn against a bank located in

the same processing region as the depository bank. The check-processing region for the State of Arizona is the Los Angeles Region.

Any check with a four-digit ABA Number beginning with “12”or “32” is “local”. On-US Checks: Next day availability is dependent on

the check being drawn against the same bank or branch as the depository bank and in the same check-processing region, meaning the

ABA numbers must begin with “12 or “32”.

12