Page 91 - DBP5043

P. 91

TYPES OF NEGOTIATED FINANCING:

1. Commercial paper

The usage of Commercial paper as a source of short-term financing in

Malaysia has not been widely spread. This is because only companies

with strong financial standing are able to produce CP. CP is issued by

the company to obtain short-term financing in a short period of time.

Commercial paper is a short-term promissory note, issued by big and

famous companies that have gained the confidence of investors who

believe the company's ability to repay them when redeeming their

commercial paper at maturity.

Typically, the commercial paper is issued at a discount. This means

that when sold to investors, the price will be deducted by the interest.

At maturity, the investor will redeem at face value. In this case, the

issuer of commercial paper is the borrower and the investor is the

lender.

An additional feature is the existence of the Commercial Paper

issuance costs as a third party (bank or service security company

operator) to distribute such Commercial Paper to the public in

addition to other costs that are directly involved in the issuance of

Commercial Paper. All these costs must be taken into account in

calculating the EC.

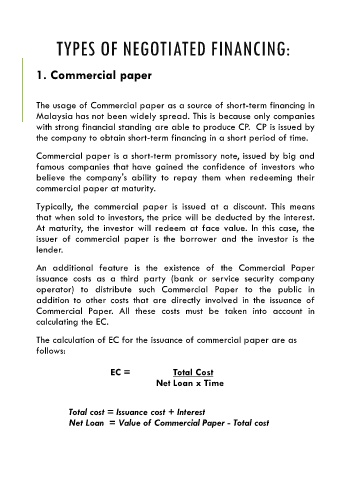

The calculation of EC for the issuance of commercial paper are as

follows:

EC = Total Cost

Net Loan x Time

Total cost = Issuance cost + Interest

Net Loan = Value of Commercial Paper - Total cost