Page 36 - C:\Users\jsalazar145\Documents\Flip PDF Professional\new-employees-benefits-guide-2019 030619\

P. 36

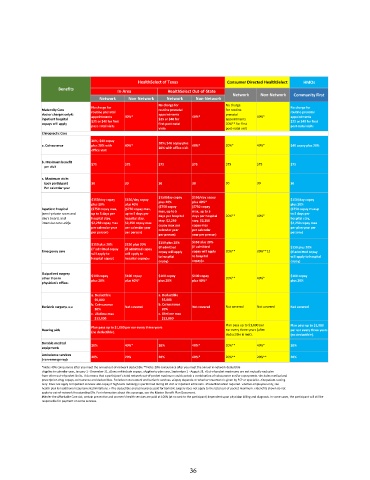

HealthSelect of Texas Consumer Directed HealthSelect HMOs

Benefits In-Area HealthSelect Out-of-State

Network Non-Network Community First

Network Non-Network Network Non-Network

No charge for No charge

No charge for No charge for

Maternity Care routine prenatal routine prenatal for routine routine prenatal

doctor charges only#; appointments 40%* appointments 40%* prenatal 40%* appointments

inpatient hospital $25 or $40 for first $25 or $40 for appointments $25 or $40 for first

copays will apply first post-natal 20%** for first

post-natal visit6 post-natal visit post-natal visit6

visit6

Chiropractic Care

20%; $40 copay

a. Coinsurance plus 20% with 40%* 20%; $40 copay plus 40%* 20%* 40%* $40 copay plus 20%

20% with office visit

office visit

b. Maximum benefit $75 $75

per visit $75 $75 $75 $75 $75

c. Maximum visits

Each participant 30 30 30 30 30 30 30

Per calendar year

$150/day copay $150/day copay

$150/day copay $150/day copay $150/day copay

plus 20% plus 40% plus 20% plus 40%* plus 20%

Inpatient hospital ($750 copay max, ($750 copay max, ($750 copay ($750 copay ($750 copay maxup

max, up to 5

max, up to 5

(semi-private room and up to 5 days per up to 5 days per days per hospital days per hospital 20%** 40%* to 5 days per

day’s board, and hospital stay. hospital stay. stay. $2,250 stay. $2,250 hospital stay,

intensive care unit)9 $2,250 copay max $2,250 copay max copay max per copay max $2,250 copay max

per calendar year per calendar year calendar year per calendar per plan year per

per person) per person) person3)

per person) year per person)

$150 plus 20% $150 plus 20% $150 plus 20% $150 plus 20%

(if admitted

(if admitted copay (if admitted copay (if admitted $150 plus 20%

Emergency care copay will apply copay will apply 20%** 20%**12 (if admitted copay

will apply to will apply to to hospital

hospital copay) hospital copay)12 to hospital will apply to hospital

copay) copay)12 copay)

Outpatient surgery

other than in $100 copay $100 copay $100 copay $100 copay 20%** 40%* $100 copay

plus 20% plus 40%* plus 20% plus 40%* plus 20%

physician’s office9

a. Deductible a. Deductible

$5,000 $5,000

b. Coinsurance b. Coinsurance

Bariatric surgery9,10,11 Not covered Not covered Not covered Not covered Not covered

20% 20%

c. Lifetime max c. Lifetime max

$13,000 $13,000

Plan pays up to $1,000 per Plan pays up to $1,000

Plan pays up to $1,000 per ear every three years

Hearing aids (no deductible). ear every three years (after per ear every three years

deductible is met). (no deductible).

Durable medical 20% 40%* 20% 40%* 20%** 40%* 20%

equipment9

Ambulance services

20% 20% 20% 40%* 20%** 20%** 20%

(non-emergency)9

*Note: 40% coinsurance after you meet the annual out-of-network deductible **Note: 20% coinsurance after you meet the annual in-network deductible

1Applies to calendar year, January 1 - December 31. 2Does not include copays. 3Applies to plan year, September 1 - August 31. 4Out-of-pocket maximums are not mutually exclusive

from other out-of-pocket limits. This means that a participant’s total network out-of-pocket maximum could contain a combination of coinsurance and/or copayments. 5Includes medical and

prescription drug copays, coinsurance and deductibles. Excludes non-network and bariatric services. 6Copay depends on whether treatment is given by PCP or specialist. 7Outpatient testing

only. Does not apply to inpatient services. 8No copay if high-tech radiology is performed during ER visit or inpatient admission. 9Preauthorization required. 10Active employees only; see

health plan for additional requirements/limitations. 11The deductible and coinsurance paid for bariatric surgery does not apply to the total out-of-pocket maximum. 12Benefits shown do not

apply to out-of-network freestanding ERs. For information about this coverage, see the Master Benefit Plan Document.

#Under the Affordable Care Act, certain preventive and women’s health services are paid at 100% (at no cost to the participant) dependent upon physician billing and diagnosis. In some cases, the participant will still be

responsible for payment on some services.

36