Page 18 - NOT FOR SELL SIBUSISIWEFXupdate_Neat

P. 18

In general RSI is used in Five Different Ways:

Top and Bottoms – Overbought and Oversold conditions are usually signalled at 30 and 70.

Divergences – When a pair makes new high (lows) but RSI does not, this usually indicates that a

reversal in price is coming.

Support and Resistance – RSI may show levels of support and resistance, sometimes more clearly

than the price chart itself.

Chart Formations – Patterns such as double tops and head and shoulder may be more visible on RSI

rather than on the price charts.

Failure Swings – When RSI breaks out (surpasses previous highs or lows), this may indicate that a

breakout in price is coming.

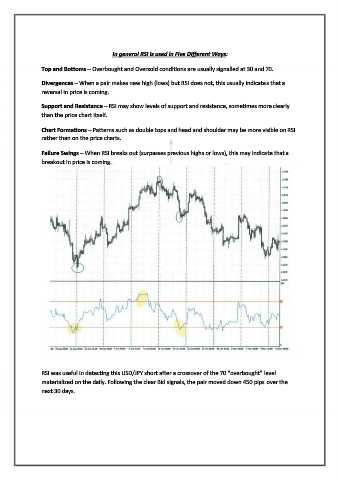

RSI was useful in detecting this USD/JPY short after a crossover of the 70 “overbought” level

materialized on the daily. Following the clear Bid signals, the pair moved down 450 pips over the

next 30 days.