Page 313 - Krugmans Economics for AP Text Book_Neat

P. 313

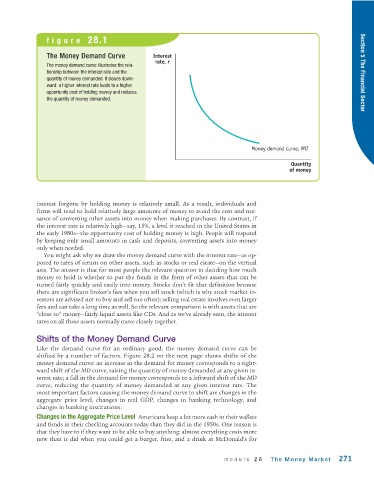

figure 28.1

The Money Demand Curve Interest

rate, r

The money demand curve illustrates the rela-

tionship between the interest rate and the Section 5 The Financial Sector

quantity of money demanded. It slopes down-

ward: a higher interest rate leads to a higher

opportunity cost of holding money and reduces

the quantity of money demanded.

Money demand curve, MD

Quantity

of money

interest forgone by holding money is relatively small. As a result, individuals and

firms will tend to hold relatively large amounts of money to avoid the cost and nui-

sance of converting other assets into money when making purchases. By contrast, if

the interest rate is relatively high—say, 15%, a level it reached in the United States in

the early 1980s—the opportunity cost of holding money is high. People will respond

by keeping only small amounts in cash and deposits, converting assets into money

only when needed.

You might ask why we draw the money demand curve with the interest rate—as op-

posed to rates of return on other assets, such as stocks or real estate—on the vertical

axis. The answer is that for most people the relevant question in deciding how much

money to hold is whether to put the funds in the form of other assets that can be

turned fairly quickly and easily into money. Stocks don’t fit that definition because

there are significant broker’s fees when you sell stock (which is why stock market in-

vestors are advised not to buy and sell too often); selling real estate involves even larger

fees and can take a long time as well. So the relevant comparison is with assets that are

“close to” money—fairly liquid assets like CDs. And as we’ve already seen, the interest

rates on all these assets normally move closely together.

Shifts of the Money Demand Curve

Like the demand curve for an ordinary good, the money demand curve can be

shifted by a number of factors. Figure 28.2 on the next page shows shifts of the

money demand curve: an increase in the demand for money corresponds to a right-

ward shift of the MD curve, raising the quantity of money demanded at any given in-

terest rate; a fall in the demand for money corresponds to a leftward shift of the MD

curve, reducing the quantity of money demanded at any given interest rate. The

most important factors causing the money demand curve to shift are changes in the

aggregate price level, changes in real GDP, changes in banking technology, and

changes in banking institutions.

Changes in the Aggregate Price Level Americans keep a lot more cash in their wallets

and funds in their checking accounts today than they did in the 1950s. One reason is

that they have to if they want to be able to buy anything: almost everything costs more

now than it did when you could get a burger, fries, and a drink at McDonald’s for

module 28 The Money Market 271