Page 480 - Krugmans Economics for AP Text Book_Neat

P. 480

fyi

From Bretton Woods to the Euro

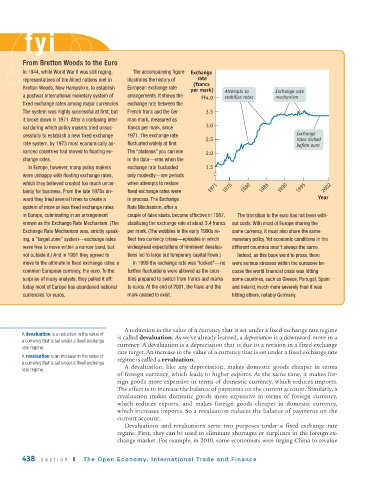

In 1944, while World War II was still raging, The accompanying figure Exchange

representatives of the Allied nations met in illustrates the history of rate

(francs

Bretton Woods, New Hampshire, to establish European exchange rate

per mark) Attempts to Exchange rate

a postwar international monetary system of arrangements. It shows the FF4.0 stabilize rates mechanism

fixed exchange rates among major currencies. exchange rate between the

The system was highly successful at first, but French franc and the Ger- 3.5

it broke down in 1971. After a confusing inter- man mark, measured as

3.0

val during which policy makers tried unsuc- francs per mark, since

cessfully to establish a new fixed exchange 1971. The exchange rate Exchange

2.5 rates locked

rate system, by 1973 most economically ad- fluctuated widely at first. before euro

vanced countries had moved to floating ex- The “plateaus” you can see 2.0

change rates. in the data—eras when the

In Europe, however, many policy makers exchange rate fluctuated 1.5

were unhappy with floating exchange rates, only modestly—are periods

which they believed created too much uncer- when attempts to restore

tainty for business. From the late 1970s on- fixed exchange rates were 1971 1975 1980 1985 1990 1995 2002

ward they tried several times to create a in process. The Exchange Year

system of more or less fixed exchange rates Rate Mechanism, after a

in Europe, culminating in an arrangement couple of false starts, became effective in 1987, The transition to the euro has not been with-

known as the Exchange Rate Mechanism. (The stabilizing the exchange rate at about 3.4 francs out costs. With most of Europe sharing the

Exchange Rate Mechanism was, strictly speak- per mark. (The wobbles in the early 1990s re- same currency, it must also share the same

ing, a “target zone” system—exchange rates flect two currency crises—episodes in which monetary policy. Yet economic conditions in the

were free to move within a narrow band, but widespread expectations of imminent devalua- different countries aren’t always the same.

not outside it.) And in 1991 they agreed to tions led to large but temporary capital flows.) Indeed, as this book went to press, there

move to the ultimate in fixed exchange rates: a In 1999 the exchange rate was “locked”—no were serious stresses within the eurozone be-

common European currency, the euro. To the further fluctuations were allowed as the coun- cause the world financial crisis was hitting

surprise of many analysts, they pulled it off: tries prepared to switch from francs and marks some countries, such as Greece, Portugal, Spain

today most of Europe has abandoned national to euros. At the end of 2001, the franc and the and Ireland, much more severely than it was

currencies for euros. mark ceased to exist. hitting others, notably Germany.

A reduction in the value of a currency that is set under a fixed exchange rate regime

A devaluation is a reduction in the value of

is called devaluation. As we’ve already learned, a depreciation is a downward move in a

a currency that is set under a fixed exchange

currency. A devaluation is a depreciation that is due to a revision in a fixed exchange

rate regime.

rate target. An increase in the value of a currency that is set under a fixed exchange rate

A revaluation is an increase in the value of

regime is called a revaluation.

a currency that is set under a fixed exchange

A devaluation, like any depreciation, makes domestic goods cheaper in terms

rate regime.

of foreign currency, which leads to higher exports. At the same time, it makes for-

eign goods more expensive in terms of domestic currency, which reduces imports.

The effect is to increase the balance of payments on the current account. Similarly, a

revaluation makes domestic goods more expensive in terms of foreign currency,

which reduces exports, and makes foreign goods cheaper in domestic currency,

which increases imports. So a revaluation reduces the balance of payments on the

current account.

Devaluations and revaluations serve two purposes under a fixed exchange rate

regime. First, they can be used to eliminate shortages or surpluses in the foreign ex-

change market. For example, in 2010, some economists were urging China to revalue

438 section 8 The Open Economy: Inter national Trade and Finance