Page 922 - Krugmans Economics for AP Text Book_Neat

P. 922

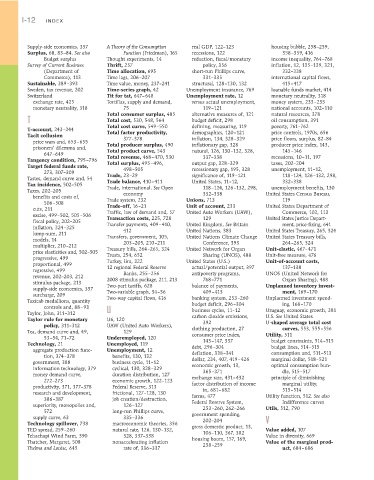

I-12 INDEX

Supply-side economics, 357 A Theory of the Consumption real GDP, 122–123 housing bubble, 258–259,

Surplus, 68, 83–84. See also Function (Friedman), 165 recessions, 122 358–359, 416

Budget surplus Thought experiments, 14 reduction, fiscal/monetary income inequality, 764–768

Survey of Current Business Thrift, 257 policy, 356 inflation, 12, 135–139, 321,

(Department of Time allocation, 695 short-run Phillips curve, 332–338

Commerce), 113 Time lags, 206–207 331–335 international capital flows,

Sustainable, 389–393 Time value, money, 237–241 structural, 128–130, 132 415–417

Sweden, tax revenue, 202 Time-series graph, 42 Unemployment insurance, 769 loanable funds market, 414

Switzerland Tit for tat, 647–648 Unemployment rate, 12 monetary neutrality, 318

exchange rate, 425 Tortillas, supply and demand, versus actual unemployment, money system, 233–235

monetary neutrality, 318 75 119–121 national accounts, 102–110

T Total consumer surplus, 485 alternative measures of, 121 natural resources, 378

Total cost, 530, 548, 564

budget deficit, 298

oil consumption, 391

Total cost curve, 549–550 defining, measuring, 119 poverty, 761–762

T-account, 243–244 Total factor productivity, demographics, 120–121 price controls, 1970s, 656

Tacit collusion 377–378 inflation, 134, 328–329 price floors, surplus, 82–84

price wars and, 653–655 Total producer surplus, 490 inflationary gap, 328 producer price index, 143,

prisoners’ dilemma and, Total product curve, 543 natural, 126, 130–132, 328, 145–146

647–649

337–338

Tangency condition, 795–796 Total revenue, 468–470, 530 output gap, 328–329 recessions, 10–11, 197

taxes, 202–204

Total surplus, 495–496,

Target federal funds rate, 498–505 recessionary gap, 195, 328 unemployment, 11–12,

273, 307–309

Tastes, demand curve and, 54 Trade, 23–29 significance of, 119–121 118–124, 126–132, 298,

332–338

Trade balance, 410–411

United States, 11–12,

Tax incidence, 502–505 Trade, international. See Open 118–124, 126–132, 298, unemployment benefits, 130

Taxes, 202–205 economy 332–338 United States Census Bureau,

benefits and costs of, Trade system, 232 Unions, 713 119

506–508

cuts, 211 Trade-off, 16–21 Unit of account, 233 United States Department of

Commerce, 102, 113

Traffic, law of demand and, 57

United Auto Workers (UAW),

excise, 499–502, 505–506 Transaction costs, 225, 728 129 United States Justice Depart -

fiscal policy, 202–205 Transfer payments, 409–410, United Kingdom. See Britain ment, price-fixing, 641

inflation, 324–325 412 United Nations, 383 United States Treasury, 265, 324

lump-sum, 211 Transfers, government, 105, United Nations Climate Change United States Treasury bills,

models, 14 203–205, 210–211 Conference, 393 264–265, 324

multiplier, 210–212 Treasury bills, 264–265, 324 United Network for Organ Unit-elastic, 467–471

price elasticities and, 502–505 Trusts, 254, 652 Sharing (UNOS), 488 Unit-free measure, 476

progressive, 499 Turkey, lira, 322 United States (U.S.) Unit-of-account costs,

proportional, 499 12 regional Federal Reserve actual/potential output, 397 137–138

regressive, 499 Banks, 255–256 antipoverty programs, UNOS (United Network for

revenue, 202–203, 212 2008 stimulus package, 211, 213 768–771 Organ Sharing), 488

stimulus package, 213 Two-part tariffs, 628 balance of payments, Unplanned inventory invest-

supply-side economics, 357 Two-variable graph, 34–36 409–413 ment, 169–170

surcharge, 209

Taxicab medallions, quantity Two-way capital flows, 416 banking system, 253–260 Unplanned investment spend-

budget deficit, 296–304

ing, 168–170

controls and, 88–93 U

Taylor, John, 311–312 business cycles, 11–12 Uruguay, economic growth, 381

carbon dioxide emissions,

U.S. See United States

Taylor rule for monetary U6, 120 392 U-shaped average total cost

policy, 311–312 UAW (United Auto Workers),

curves, 553, 555–556

Tea, demand curve and, 49, 129 clothing production, 27 Utility, 511

consumer price index,

53–54, 71–72 Underemployed, 120

143–147, 337

Technology, 21 Unemployed, 119 debt, 296–304 budget constraints, 514–515

budget lines, 514–515

aggregate production func- Unemployment, 12 deflation, 338–341 consumption and, 511–513

tion, 374–378 benefits, 130, 132

government, 388 business cycle, 11–12 dollar, 234, 407, 419–426 marginal dollar, 518–521

economic growth, 13,

optimal consumption bun-

information technology, 379 cyclical, 130, 328–329 365–371 dle, 515–517

money demand curve, duration distribution, 127 exchange rate, 431–432 principle of diminishing

272–273 economic growth, 122–123

productivity, 371, 377–378 Federal Reserve, 313 factor distribution of income marginal utility,

513–514

in, 681–682

research and development, frictional, 127–128, 130 farms, 477 Utility function, 512. See also

386–387 job creation/destruction,

Indifference curves

superiority, monopolies and, 126–127 Federal Reserve System, Utils, 512, 790

253–260, 262–266

572 long-run Phillips curve,

supply curve, 63 335–336 government spending, V

202–204

Technology spillover, 738 macroeconomic theories, 356 gross domestic product, 13,

TED spread, 259–260 natural rate, 126, 130–132, 106–110, 367, 382 Value added, 107

Tehachapi Wind Farm, 390 328, 337–338 housing boom, 157, 169, Value in diversity, 669

Thatcher, Margaret, 508 nonaccelerating inflation 258–259 Value of the marginal prod-

Thelma and Louise, 645 rate of, 336–337 uct, 684–686