Page 31 - Listing Partners Pre Listing Offering

P. 31

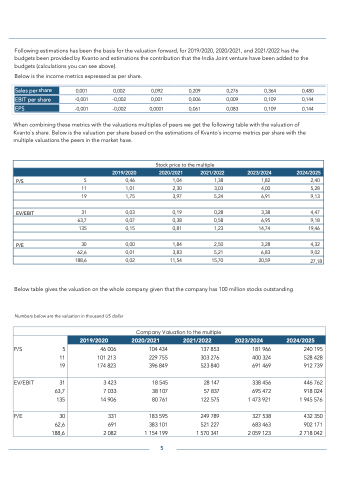

Following estimations has been the basis for the valuation forward, for 2019/2020, 2020/2021, and 2021/2022 has the budgets been provided by Kvanto and estimations the contribution that the India Joint venture have been added to the budgets (calculations you can see above).

Below is the income metrics expressed as per share.

When combining these metrics with the valuations multiples of peers we get the following table with the valuation of Kvanto`s share. Below is the valuation per share based on the estimations of Kvanto´s income metrics per share with the multiple valuations the peers in the market have.

Sales per share

0,001 0,002 0,092 0,209 0,276 0,364 0,480 -0,001 -0,002 0,001 0,006 0,009 0,109 0,144

EBIT per share

EPS

-0,001 -0,002 0,0001 0,061 0,083 0,109 0,144

Stock price to the multiple

2019/2020 2020/2021 2021/2022 2023/2024 2024/2025

P/S

5 0,46 1,04 1,38 1,82 2,40

11 1,01 2,30 3,03 4,00 5,28

19 1,75 3,97 5,24 6,91 9,13

EV/EBIT

31 0,03 0,19 0,28 3,38 4,47

63,7 0,07 0,38 0,58 6,95 9,18

135 0,15 0,81 1,23 14,74 19,46

P/E

30 0,00 1,84 2,50 3,28 4,32

62,6 0,01 3,83 5,21 6,83 9,02

188,6 0,02 11,54 15,70 20,59

27,18

Below table gives the valuation on the whole company given that the company has 100 million stocks outstanding

Numbers below are the valuation in thousand US dollar

Company Valuation to the multiple

P/S 5 11 19

2019/2020 2020/2021 2021/2022 2023/2024 2024/2025

46 006 101 213 174 823

104 434 229 755 396 849

137 853 303 276 523 840

181 966 400 324 691 469

240 195 528 428 912 739

EV/EBIT 31 63,7 135

3 423

7 033 14 906

18 545 38 107 80 761

28 147

57 837 122 575

338 456

695 472 1 473 921

446 762

918 024 1 945 576

P/E 30 62,6 188,6

331

691 2 082

183 595

383 101 1 154 199

249 789

521 227 1 570 341

327 538

683 463 2 059 123

432 350

902 171 2 718 042

5