Page 32 - Listing Partners Pre Listing Offering

P. 32

During 2019/2020 the potential looks slim as the margins are not that high, but the growth is high as the India project kicks off and start to contribute to the top line. Later on will also the margins start

to increase as Kvanto will reach their critical mass of transactions andthe start-up cost of the joint venture will start bearing fruit, andyou see a spike in the valuation to earnings in 2020/2021.

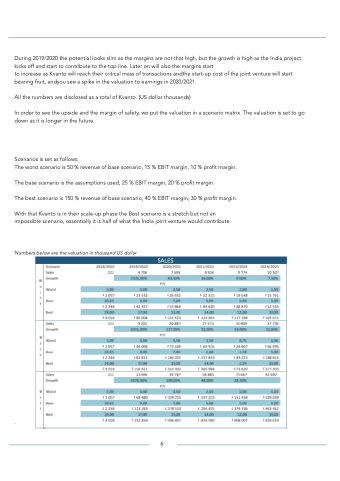

All the numbers are disclosed as a total of Kvanto. (US dollar thousands)

In order to see the upside and the margin of safety, we put the valuation in a scenario matrix. The valuation is set to go down as it is longer in the future.

Scenarios is set as follows:

The worst scenario is 50 % revenue of base scenario, 15 % EBIT margin, 10 % profit margin.

The base scenario is the assumptions used, 25 % EBIT margin, 20 % profit margin.

The best scenario is 150 % revenue of base scenario, 40 % EBIT margin, 30 % profit margin.

With that Kvanto is in their scale-up phase the Best scenario is a stretch but not an impossible scenario, essentially it is half of what the India joint venture would contribute.

Numbers below are the valuation in thousand US dollar

.

SALES

6

.