Page 34 - Listing Partners Pre Listing Offering

P. 34

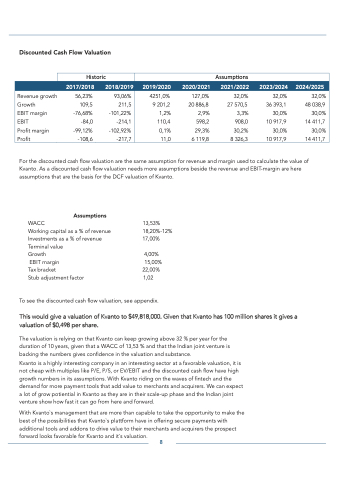

Discounted Cash Flow Valuation

Revenue growth 56,23% Growth 109,5 EBIT margin -76,68% EBIT -84,0 Profit margin -99,12% Profit -108,6

93,06% 211,5 -101,22% -214,1 -102,92% -217,7

Historic

2017/2018 2018/2019

Assumpons

2019/2020 2020/2021 2021/2022 2023/2024 2024/2025

4251,0% 9 201,2 1,2% 110,4

0,1% 11,0

127,0% 20 886,8

2,9% 598,2 29,3% 6 119,8

32,0% 27 570,5

3,3% 908,0 30,2% 8 326,3

32,0% 36 393,1 30,0% 10 917,9

30,0% 10 917,9

32,0% 48 038,9 30,0% 14 411,7

30,0% 14 411,7

For the discounted cash flow valuation are the same assumption for revenue and margin used to calculate the value of Kvanto. As a discounted cash flow valuation needs more assumptions beside the revenue and EBIT-margin are here assumptions that are the basis for the DCF valuation of Kvanto.

Assumptions

WACC

Working capital as a % of revenue Investments as a % of revenue Terminal value

Growth

EBIT margin

Tax bracket

Stub adjustment factor

13,53% 18,20%-12% 17,00%

4,00%

15,00% 22,00%

1,02 To see the discounted cash flow valuation, see appendix.

This would give a valuation of Kvanto to $49,818,000. Given that Kvanto has 100 million shares it gives a valuation of $0,498 per share.

The valuation is relying on that Kvanto can keep growing above 32 % per year for the duration of 10 years, given that a WACC of 13,53 % and that the Indian joint venture is backing the numbers gives confidence in the valuation and substance.

Kvanto is a highly interesting company in an interesting sector at a favorable valuation, it is not cheap with multiples like P/E, P/S, or EV/EBIT and the discounted cash flow have high growth numbers in its assumptions. With Kvanto riding on the waves of fintech and the demand for more payment tools that add value to merchants and acquirers. We can expect a lot of grow potiential in Kvanto as they are in their scale-up phase and the Indian joint venture show how fast it can go from here and forward.

With Kvanto`s management that are more than capable to take the opportunity to make the best of the possibilities that Kvanto`s plattform have in offering secure payments with additional tools and addons to drive value to their merchants and acquirers the prospect forward looks favorable for Kvanto and it`s valuation.

8