Page 126 - Sample Financial Plan 4-1-2019 v2

P. 126

Saving for education is an investment in a child’s future. On average, today’s college graduates

will earn almost double the income compared to those with only a high school diploma.

What’s more, the occupations available to college graduates provide more benefits, from

healthcare insurance to retirement savings. Plus, college graduates tend to be more satisfied

with their jobs and statistically live an average of seven years longer than non-college

graduates.

The reasons for college are clear, but finding a way to pay for it may not be. However, starting

early with an effective savings strategy can make the opportunity of college a reality. The

Oklahoma 529 College Savings Plan (OCSP) offers an affordable, tax-advantaged way to save,

and it’s the only plan with an Oklahoma income tax deduction.

Take some time to read the enclosed enrollment kit to find out more about the benefits of

OCSP. You can enroll by completing the enclosed application or online.

For more information about OCSP, visit ok4saving.org or contact one of our college savings

specialists at 877 654-7284.

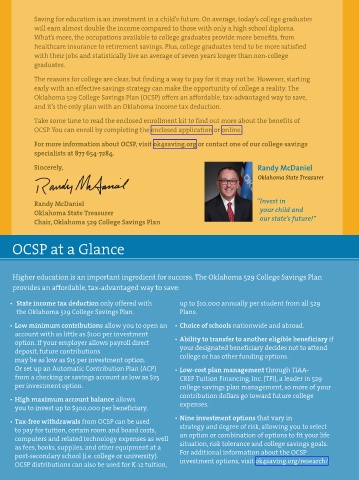

Sincerely, Randy McDaniel

Oklahoma State Treasurer

“ Invest in

Randy McDaniel

your child and

Oklahoma State Treasurer

our state’s future!”

Chair, Oklahoma 529 College Savings Plan

OCSP at a Glance

Higher education is an important ingredient for success. The Oklahoma 529 College Savings Plan

provides an affordable, tax-advantaged way to save:

• State income tax deduction only offered with up to $10,000 annually per student from all 529

the Oklahoma 529 College Savings Plan. Plans.

• Low minimum contributions allow you to open an • Choice of schools nationwide and abroad.

account with as little as $100 per investment

option. If your employer allows payroll direct • Ability to transfer to another eligible beneficiary if

deposit, future contributions your designated beneficiary decides not to attend

college or has other funding options.

may be as low as $15 per investment option.

Or set up an Automatic Contribution Plan (ACP) • Low-cost plan management through TIAA-

from a checking or savings account as low as $25 CREF Tuition Financing, Inc. (TFI), a leader in 529

per investment option. college savings plan management, so more of your

contribution dollars go toward future college

• High maximum account balance allows

expenses.

you to invest up to $300,000 per beneficiary.

• Nine investment options that vary in

• Tax-free withdrawals from OCSP can be used

to pay for tuition, certain room and board costs, strategy and degree of risk, allowing you to select

computers and related technology expenses as well an option or combination of options to fit your life

as fees, books, supplies, and other equipment at a situation, risk tolerance and college savings goals.

post-secondary school (i.e. college or university). For additional information about the OCSP

investment options, visit ok4saving.org/research/.

OCSP distributions can also be used for K-12 tuition,