Page 2 - Market Update 10-31-2021.xlsx

P. 2

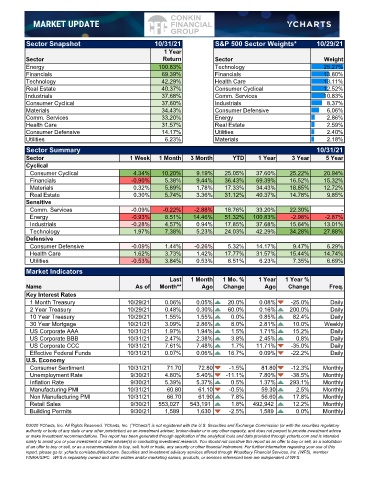

Sector Snapshot 10/31/21 S&P 500 Sector Weights* 10/29/21

1 Year

Sector Return Sector Weight

Energy 100.83% Technology 25.27%

Financials 69.39% Financials 13.80%

Technology 42.29% Health Care 13.11%

Real Estate 40.37% Consumer Cyclical 12.52%

Industrials 37.68% Comm. Services 10.83%

Consumer Cyclical 37.60% Industrials 8.37%

Materials 34.43% Consumer Defensive 6.06%

Comm. Services 33.20% Energy 2.86%

Health Care 31.57% Real Estate 2.59%

Consumer Defensive 14.17% Utilities 2.40%

Utilities 6.23% Materials 2.18%

Sector Summary 10/31/21

Sector 1 Week 1 Month 3 Month YTD 1 Year 3 Year 5 Year

Cyclical

Consumer Cyclical 4.34% 10.20% 9.19% 25.05% 37.60% 25.22% 20.94%

Financials -0.90% 5.38% 9.44% 36.43% 69.39% 16.52% 15.32%

Materials 0.32% 5.89% 1.78% 17.33% 34.43% 18.85% 12.72%

Real Estate 0.30% 5.74% 3.36% 31.12% 40.37% 14.78% 9.85%

Sensitive

Comm. Services -0.09% -0.22% -2.88% 18.76% 33.20% 22.30% -

Energy -0.93% 8.51% 14.46% 51.32% 100.83% -2.98% -2.87%

Industrials -0.28% 4.57% 0.94% 17.85% 37.68% 15.64% 13.01%

Technology 1.97% 7.38% 5.23% 24.03% 42.29% 34.28% 27.88%

Defensive

Consumer Defensive -0.09% 1.44% -0.26% 5.32% 14.17% 9.47% 6.29%

Health Care 1.62% 3.73% 1.42% 17.77% 31.57% 15.44% 14.74%

Utilities -0.53% 3.84% 0.53% 6.51% 6.23% 7.35% 6.69%

Market Indicators

Last 1 Month 1 Mo. % 1 Year 1 Year %

Name As of Month** Ago Change Ago Change Freq.

Key Interest Rates

1 Month Treasury 10/29/21 0.06% 0.05% 20.0% 0.08% -25.0% Daily

2 Year Treasury 10/29/21 0.48% 0.30% 60.0% 0.16% 200.0% Daily

10 Year Treasury 10/29/21 1.55% 1.55% 0.0% 0.85% 82.4% Daily

30 Year Mortgage 10/21/21 3.09% 2.86% 8.0% 2.81% 10.0% Weekly

US Corporate AAA 10/31/21 1.97% 1.94% 1.5% 1.71% 15.2% Daily

US Corporate BBB 10/31/21 2.47% 2.38% 3.8% 2.45% 0.8% Daily

US Corporate CCC 10/31/21 7.61% 7.48% 1.7% 11.71% -35.0% Daily

Effective Federal Funds 10/31/21 0.07% 0.06% 16.7% 0.09% -22.2% Daily

U.S. Economy

Consumer Sentiment 10/31/21 71.70 72.80 -1.5% 81.80 -12.3% Monthly

Unemployment Rate 9/30/21 4.80% 5.40% -11.1% 7.80% -38.5% Monthly

Inflation Rate 9/30/21 5.39% 5.37% 0.5% 1.37% 293.1% Monthly

Manufacturing PMI 10/31/21 60.80 61.10 -0.5% 59.30 2.5% Monthly

Non Manufacturing PMI 10/31/21 66.70 61.90 7.8% 56.60 17.8% Monthly

Retail Sales 9/30/21 553,027 543,191 1.8% 492,942 12.2% Monthly

Building Permits 9/30/21 1,589 1,630 -2.5% 1,589 0.0% Monthly

©2020 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory

authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice

or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended

solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation

of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this

report, please go to: ycharts.com/about/disclosure. Securities and investment advisory services offered through Woodbury Financial Services, Inc. (WFS), member

FINRA/SIPC. WFS is separately owned and other entities and/or marketing names, products, or services referenced here are independent of WFS.