Page 2 - Market_Update 3-31-2020.xlsx

P. 2

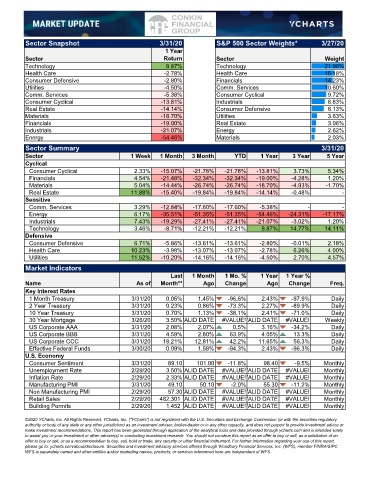

Sector Snapshot 3/31/20 S&P 500 Sector Weights* 3/27/20

1 Year

Sector Return Sector Weight

Technology 8.87% Technology 21.96%

Health Care -2.78% Health Care 15.18%

Consumer Defensive -2.80% Financials 14.23%

Utilities -4.50% Comm. Services 10.60%

Comm. Services -5.38% Consumer Cyclical 9.72%

Consumer Cyclical -13.81% Industrials 8.83%

Real Estate -14.14% Consumer Defensive 8.13%

Materials -18.70% Utilities 3.63%

Financials -19.00% Real Estate 3.06%

Industrials -21.07% Energy 2.62%

Energy -54.46% Materials 2.03%

Sector Summary 3/31/20

Sector 1 Week 1 Month 3 Month YTD 1 Year 3 Year 5 Year

Cyclical

Consumer Cyclical 2.33% -15.07% -21.78% -21.78% -13.81% 3.73% 5.34%

Financials 4.54% -21.48% -32.34% -32.34% -19.00% -4.28% 1.20%

Materials 5.04% -14.44% -26.74% -26.74% -18.70% -4.93% -1.70%

Real Estate 11.88% -15.40% -19.84% -19.84% -14.14% -0.48% -

Sensitive

Comm. Services 3.29% -12.84% -17.60% -17.60% -5.38% - -

Energy 6.17% -35.51% -51.35% -51.35% -54.46% -24.31% -17.17%

Industrials 7.43% -19.29% -27.41% -27.41% -21.07% -3.02% 1.20%

Technology 3.46% -8.71% -12.21% -12.21% 8.87% 14.77% 14.11%

Defensive

Consumer Defensive 6.71% -5.86% -13.61% -13.61% -2.80% -0.01% 2.18%

Health Care 10.23% -3.98% -13.07% -13.07% -2.78% 6.26% 4.00%

Utilities 11.52% -10.20% -14.16% -14.16% -4.50% 2.70% 4.57%

Market Indicators

Last 1 Month 1 Mo. % 1 Year 1 Year %

Name As of Month** Ago Change Ago Change Freq.

Key Interest Rates

1 Month Treasury 3/31/20 0.05% 1.45% -96.6% 2.43% -97.9% Daily

2 Year Treasury 3/31/20 0.23% 0.86% -73.3% 2.27% -89.9% Daily

10 Year Treasury 3/31/20 0.70% 1.13% -38.1% 2.41% -71.0% Daily

30 Year Mortgage 3/26/20 3.50% VALID DATE #VALUE!VALID DATE #VALUE! Weekly

US Corporate AAA 3/31/20 2.08% 2.07% 0.5% 3.16% -34.2% Daily

US Corporate BBB 3/31/20 4.59% 2.80% 63.9% 4.05% 13.3% Daily

US Corporate CCC 3/31/20 18.21% 12.81% 42.2% 11.65% 56.3% Daily

Effective Federal Funds 3/30/20 0.09% 1.58% -94.3% 2.43% -96.3% Daily

U.S. Economy

Consumer Sentiment 3/31/20 89.10 101.00 -11.8% 98.40 -9.5% Monthly

Unemployment Rate 2/29/20 3.50% VALID DATE #VALUE!VALID DATE #VALUE! Monthly

Inflation Rate 2/29/20 2.33%VALID DATE #VALUE!VALID DATE #VALUE! Monthly

Manufacturing PMI 3/31/20 49.10 50.10 -2.0% 55.30 -11.2% Monthly

Non Manufacturing PMI 2/29/20 57.30 VALID DATE #VALUE!VALID DATE #VALUE! Monthly

Retail Sales 2/29/20 462,301VALID DATE #VALUE!VALID DATE #VALUE! Monthly

Building Permits 2/29/20 1,452VALID DATE #VALUE!VALID DATE #VALUE! Monthly

©2020 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory

authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or

make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely

to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an

offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report,

please go to: ycharts.com/about/disclosure. Securities and investment advisory services offered through Woodbury Financial Services, Inc. (WFS), member FINRA/SIPC.

WFS is separately owned and other entities and/or marketing names, products, or services referenced here are independent of WFS.