Page 10 - This Month at Sansum Clinic – June 2021

P. 10

Financial Update

Sansum’s Money Matters WITH TRACY KERN, CONTROLLER

To ensure our Sansum team gets what is due to them for any driving done on behalf of the Clinic, its time for a refresher on

how you calculate and request your mileage reimbursement.

The rules and requirements for Sansum Clinic’s mileage reimbursement policy are dictated by the IRS. The amount reimbursed per mile is updated by the IRS every year and is intended to compensate you for both

the cost of fuel and wear and tear on your vehicle. The most

basic tenant of the IRS’s reimbursement policy, is that Sansum cannot reimburse any employee for their normal daily commute. That rule determines the calculation for mileage reimbursement.

WHAT’S THE MATH?

l1 Calculate your normal daily commute (your trip from your home to your assigned location and back home again.)

l2 Calculate the TOTAL mileage you incurred on the day you did additional driving for the clinic from the when you left for work to each of your destinations (excluding personal driving for lunch, errands, etc.)

3 Subtract your daily commute total from your special drive day total. l

l4 The net amount is the mileage due to you.

Calculating your mileage this way ensures you get credit for every extra

mile you drove.

But someone told me to use the round trip mileage from my regular Clinic location to the alternate location I drove to!

That ONLY works if you drove to your regular location first, then you drive to your alternate location, then you drive back to your regular location, THEN you drive home. So, it’s always better to calculate your mileage for the day and subtract out your regular commute. That works EVERY time!

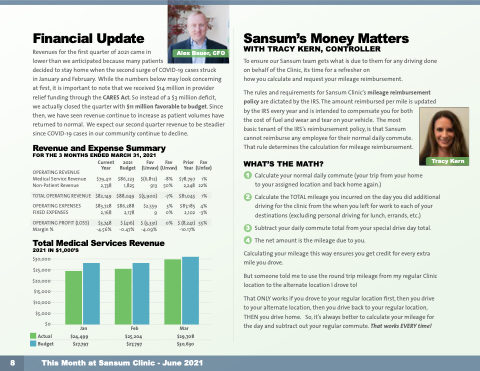

Revenues for the first quarter of 2021 came in

lower than we anticipated because many patients

decided to stay home when the second surge of COVID-19 cases struck

in January and February. While the numbers below may look concerning at first, it is important to note that we received $14 million in provider relief funding through the CARES Act. So instead of a $3 million deficit, we actually closed the quarter with $11 million favorable to budget. Since then, we have seen revenue continue to increase as patient volumes have returned to normal. We expect our second quarter revenue to be steadier since COVID-19 cases in our community continue to decline.

Revenue and Expense Summary FOR THE 3 MONTHS ENDED MARCH 31, 2021

OPERATING REVENUE Medical Service Revenue Non-Patient Revenue

TOTAL OPERATING REVENUE

OPERATING EXPENSES FIXED EXPENSES

OPERATING PROFIT (LOSS)

Margin %

Current Year

$79,411 2,738

$82,149

$83,728 2,168

$3,748

-4.56%

2021 Budget

$86,223 1,825

$88,049

$86,288 2,178

$ (416)

-0.47%

Fav Fav (Unvav) (Unvav)

Prior Fav Year (Unfav)

$78,797 1%

$(6,812) 913

$(5,900)

$2,559 9

$ (3,331)

-4.09%

-8% 50%

-7%

3% 0%

0%

2,248

22%

Alex Bauer, CFO

$81,045 1%

Tracy Kern

$87,185 2,102 -3%

$ (8,241) 55%

-10.17%

4%

Total Medical Services Revenue 2021 IN $1,000’S

$30,000 $25,000 $20,000 $15,000 $10,000

$5,000 $0

Actual Budget

Jan $24,499 $27,797

Feb $25,204 $27,797

Mar $29,708 $30,630

8

This Month at Sansum Clinic - June 2021