Page 6 - Final Version MPRC COLLATERAL OPTION 4 (8.5 × 11 in) (4)_Neat

P. 6

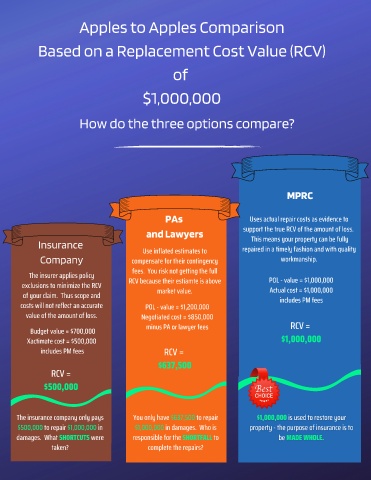

Apples to Apples Comparison

Based on a Replacement Cost Value (RCV)

of

$1,000,000

How do the three options compare?

MPRC

PAs Uses actual repair costs as evidence to

and Lawyers support the true RCV of the amount of loss.

Insurance This means your property can be fully

Use inflated estimates to repaired in a timely fashion and with quality

Company compensate for their contingency workmanship.

fees. You risk not getting the full

The insurer applies policy

RCV because their estiamte is above POL - value = $1,000,000

exclusions to minimize the RCV

market value. Actual cost = $1,000,000

of your claim. Thus scope and

includes PM fees

costs will not reflect an accurate POL - value = $1,200,000

value of the amount of loss. Negotiated cost = $850,000

minus PA or lawyer fees RCV =

Budget value = $700,000

Xactimate cost = $500,000 $1,000,000

includes PM fees RCV =

$637,500

RCV =

$500,000

The insurance company only pays You only have $637,500 to repair

$500,000 to repair $1,000,000 in $1,000,000 in damages. Who is

damages. What SHORTCUTS were responsible for the SHORTFALL to

taken? complete the repairs?