Page 128 - NIB Annual Report 12-13 | 13-14

P. 128

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2014

8. Long-term receivables, continued

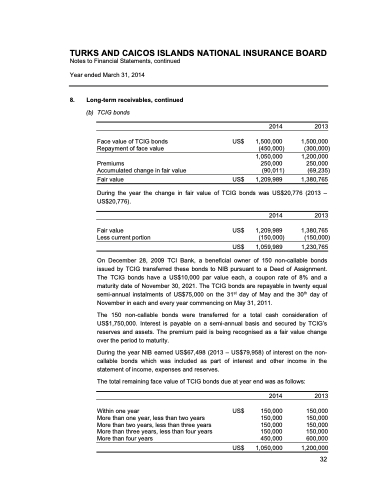

(b) TCIG bonds

Face value of TCIG bonds Repayment of face value

Premiums

Accumulated change in fair value

Fair value

US$

US$

2014

1,500,000 (450,000)

1,050,000 250,000

(90,011) 1,209,989

2013

1,500,000 (300,000)

1,200,000 250,000

(69,235) 1,380,765

During the year the change in fair value of TCIG bonds was US$20,776 (2013 – US$20,776).

2014

Fair value US$ 1,209,989 Less current portion (150,000)

US$ 1,059,989

2013

1,380,765 (150,000)

1,230,765

On December 28, 2009 TCI Bank, a beneficial owner of 150 non-callable bonds issued by TCIG transferred these bonds to NIB pursuant to a Deed of Assignment. The TCIG bonds have a US$10,000 par value each, a coupon rate of 8% and a maturity date of November 30, 2021. The TCIG bonds are repayable in twenty equal semi-annual instalments of US$75,000 on the 31st day of May and the 30th day of November in each and every year commencing on May 31, 2011.

The 150 non-callable bonds were transferred for a total cash consideration of US$1,750,000. Interest is payable on a semi-annual basis and secured by TCIG’s reserves and assets. The premium paid is being recognised as a fair value change over the period to maturity.

During the year NIB earned US$67,498 (2013 – US$79,958) of interest on the non- callable bonds which was included as part of interest and other income in the statement of income, expenses and reserves.

The total remaining face value of TCIG bonds due at year end was as follows:

2014 2013

Within one year

More than one year, less than two years More than two years, less than three years More than three years, less than four years More than four years

US$ 150,000

150,000 150,000

150,000 150,000 150,000 150,000 450,000 600,000

150,000

124| The National Insurance Board of The Turks and Caicos Islands

US$ 1,050,000

1,200,000 32