Page 129 - NIB Annual Report 12-13 | 13-14

P. 129

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2014

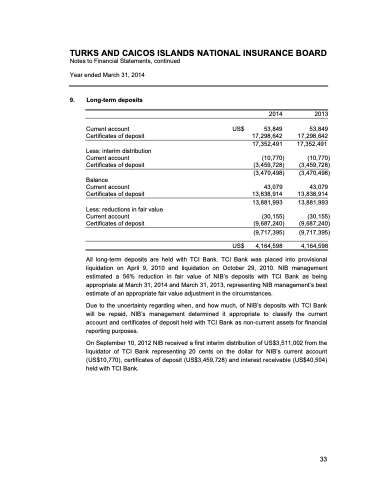

9. Long-term deposits

Current account Certificates of deposit

Less: interim distribution Current account Certificates of deposit

Balance

Current account Certificates of deposit

.

Less: reductions in fair value Current account

Certificates of deposit

US$

2014

53,849 17,298,642 17,352,491

(10,770) (3,459,728) (3,470,498)

43,079 13,838,914

13,881,993

(30,155) (9,687,240)

2013

53,849 17,298,642 17,352,491

(10,770) (3,459,728) (3,470,498)

43,079 13,838,914

13,881,993

(30,155) (9,687,240)

(9,717,395)

4,164,598

. (9,717,395) US$ 4,164,598

All long-term deposits are held with TCI Bank. TCI Bank was placed into provisional liquidation on April 9, 2010 and liquidation on October 29, 2010. NIB management estimated a 56% reduction in fair value of NIB’s deposits with TCI Bank as being appropriate at March 31, 2014 and March 31, 2013, representing NIB management’s best estimate of an appropriate fair value adjustment in the circumstances.

Due to the uncertainty regarding when, and how much, of NIB’s deposits with TCI Bank will be repaid, NIB’s management determined it appropriate to classify the current account and certificates of deposit held with TCI Bank as non-current assets for financial reporting purposes.

On September 10, 2012 NIB received a first interim distribution of US$3,511,002 from the liquidator of TCI Bank representing 20 cents on the dollar for NIB’s current account (US$10,770), certificates of deposit (US$3,459,728) and interest receivable (US$40,504) held with TCI Bank.

2013 & 2014 ANNUAL REPORT | 125 33