Page 131 - NIB Annual Report 12-13 | 13-14

P. 131

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2014

10. Property and equipment, continued

The fair value of the property including land at November 5, 2012 was approximately US$1.33 million based on a September 2012 valuation, using a cost approach, by an external, independent valuation company, with recognised and relevant professional qualifications and recent experience in the location and category of property being valued.

On January 18, 2013 TCIG granted a lease, in accordance with the provisions of the Crown Land Ordinance, to NIB for the aforementioned 0.56 acres of land. The term of the lease agreement is 999 years from the date of commencement of the lease term, being December 28, 2012. The total lease payment throughout the term of the lease is US$70,000 amortised over the lease term. Annual amortisation is included as part of depreciation expense in the statement of income, expenses and reserves.

The cost of the building and the total payments for the leased land were paid in full by NIB in November 2012 as part of the Omnibus Agreement between NIB and TCIG (note 19).

No impairment losses were recognised for the years ended March 31, 2014 and 2013.

11. Investment in TCI Bank Limited

At March 31, 2014 NIB owned 2,000,000 (2013 – 2,000,000) ordinary shares in TCI Bank with an issued value of US$2,000,000 (2013 – US$2,000,000), representing approximately 15.95% of the total issued ordinary shares of TCI Bank.

NIB was represented on the board of directors of TCI Bank.

As disclosed in notes 9 and 20 to these financial statements NIB also held a current account and certificates of deposit with TCI Bank at March 31, 2014 and 2013.

The fair value of this investment at March 31, 2014 and 2013 was assessed by NIB’s management to be US$nil as a consequence of TCI Bank entering provisional liquidation on April 9, 2010 and liquidation on October 29, 2010.

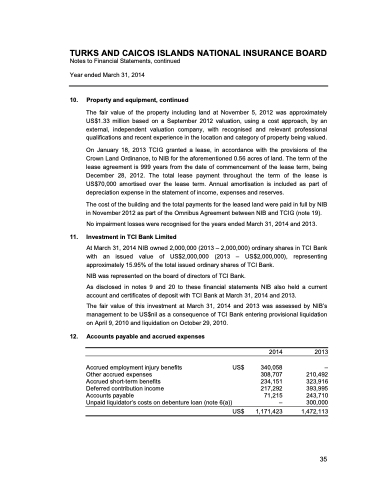

12. Accounts payable and accrued expenses

Accrued employment injury benefits Other accrued expenses

Accrued short-term benefits Deferred contribution income Accounts payable

Unpaid liquidator’s costs on debenture loan (note 6(a))

US$

US$

2014 2013

340,058 – 308,707 210,492 234,151 323,916 217,292 393,995

71,215 243,710 – 300,000

1,171,423 1,472,113

2013 & 2014 ANNUAL REPORT | 127 35