Page 143 - NIB Annual Report 12-13 | 13-14

P. 143

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2014

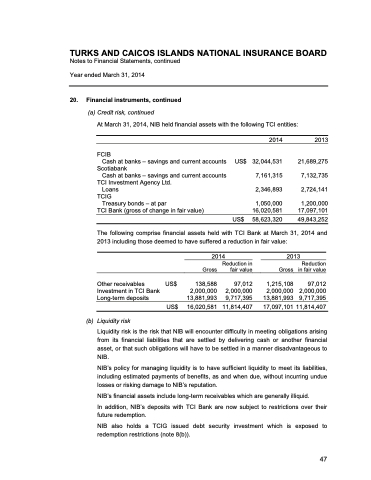

20. Financial instruments, continued

(a) Credit risk, continued

At March 31, 2014, NIB held financial assets with the following TCI entities: 2014

FCIB

Cash at banks – savings and current accounts

Scotiabank

Cash at banks – savings and current accounts

TCI Investment Agency Ltd. Loans

TCIG

Treasury bonds – at par

TCI Bank (gross of change in fair value)

US$

US$

32,044,531

7,161,315

2,346,893

1,050,000 16,020,581

58,623,320

2013

21,689,275

7,132,735

2,724,141

1,200,000 17,097,101

49,843,252

The following comprise financial assets held with TCI Bank at March 31, 2014 and 2013 including those deemed to have suffered a reduction in fair value:

Other receivables Investment in TCI Bank Long-term deposits

(b) Liquidity risk

US$

US$ 16,020,581

138,588 2,000,000 13,881,993

Gross

Reduction in fair value

97,012 2,000,000 9,717,395

11,814,407

Gross

1,215,108

2,000,000 13,881,993

17,097,101

Reduction in fair value

97,012 2,000,000 9,717,395

11,814,407

2014

2013

Liquidity risk is the risk that NIB will encounter difficulty in

from its financial liabilities that are settled by delivering cash or another financial asset, or that such obligations will have to be settled in a manner disadvantageous to NIB.

NIB’s policy for managing liquidity is to have sufficient liquidity to meet its liabilities, including estimated payments of benefits, as and when due, without incurring undue losses or risking damage to NIB’s reputation.

NIB’s financial assets include long-term receivables which are generally illiquid.

In addition, NIB’s deposits with TCI Bank are now subject to restrictions over their future redemption.

NIB also holds a TCIG issued debt security investment which is exposed to redemption restrictions (note 8(b)).

2013 & 2014 ANNUAL REPORT |139 47

meeting obligations arising