Page 145 - NIB Annual Report 12-13 | 13-14

P. 145

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2014

20. Financial instruments, continued

(c)

Market risk

Market risk is the risk that changes in market prices, such as interest rates and equity prices, will affect NIB’s income or the value of its holdings of financial instruments. The objective of market risk management is to manage and control market risk exposures within acceptable parameters, while optimising the return on risk.

NIB’s strategy for the management of market risk is driven by NIB’s investment objectives as reflected in its IPS.

NIB’s market risk is managed on a regular basis by the Investment Committee.

NIB may not invest in margin transactions; acquisition of shares that would permit the portfolio to exercise control over the issuer; uncovered speculative positions; direct investments in physical commodities; futures contracts and options and derivative investments.

(i) Interest rate risk

NIB’s operations are subject to the risk of interest rate fluctuation to the extent that interest-earning assets mature or reprice at different times or in differing amounts. Risk management activities are aimed at optimising net interest income, given market interest rate levels consistent with NIB’s strategies.

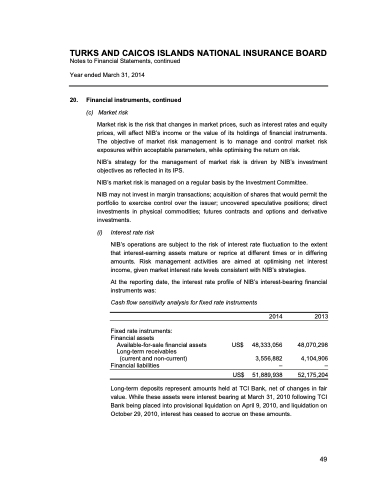

At the reporting date, the interest rate profile of NIB’s interest-bearing financial instruments was:

Cash flow sensitivity analysis for fixed rate instruments

Fixed rate instruments: Financial assets

Available-for-sale financial assets Long-term receivables

(current and non-current) Financial liabilities

2014

US$ 48,333,056

3,556,882 –

US$ 51,889,938

2013

48,070,298

4,104,906 –

52,175,204

Long-term deposits represent amounts held at TCI Bank, net of changes in fair value. While these assets were interest bearing at March 31, 2010 following TCI Bank being placed into provisional liquidation on April 9, 2010, and liquidation on October 29, 2010, interest has ceased to accrue on these amounts.

2013 & 2014 ANNUAL REPORT | 141 49