Page 56 - NIB Annual Report 12-13 | 13-14

P. 56

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

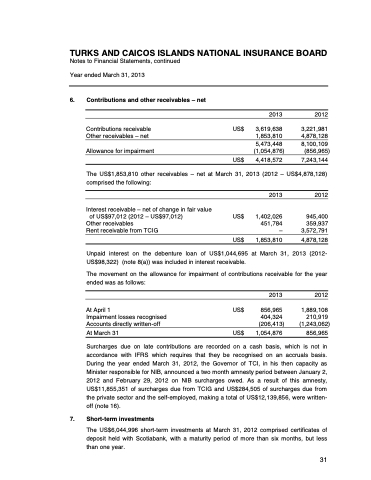

6. Contributions and other receivables – net Contributions receivable

Other receivables – net Allowance for impairment

US$

US$

2013

3,619,638 1,853,810 5,473,448 (1,054,876)

2012

3,221,981 4,878,128 8,100,109

(856,965) 7,243,144

The US$1,853,810 other receivables – net at March 31, comprised the following:

4,418,572

2013 (2012 – US$4,878,128)

Interest receivable – net of change in fair value of US$97,012 (2012 – US$97,012)

Other receivables

Rent receivable from TCIG

2013

US$ 1,402,026 451,784 –

US$ 1,853,810

2012

945,400

359,937 3,572,791

4,878,128

Unpaid interest on the debenture loan of US$1,044,695 at March 31, 2013 (2012- US$98,322) (note 8(a)) was included in interest receivable.

The movement on the allowance for impairment of contributions receivable for the year ended was as follows:

At April 1

Impairment losses recognised Accounts directly written-off

At March 31

2013 2012

US$ 856,965 1,889,108 404,324 210,919

(206,413) (1,243,062) US$ 1,054,876 856,965

Surcharges due on late contributions are recorded on a cash basis, which is not in accordance with IFRS which requires that they be recognised on an accruals basis. During the year ended March 31, 2012, the Governor of TCI, in his then capacity as Minister responsible for NIB, announced a two month amnesty period between January 2, 2012 and February 29, 2012 on NIB surcharges owed. As a result of this amnesty, US$11,855,351 of surcharges due from TCIG and US$284,505 of surcharges due from the private sector and the self-employed, making a total of US$12,139,856, were written- off (note 16).

7. Short-term investments

The US$6,044,996 short-term investments at March 31, 2012 comprised certificates of

deposit held with Scotiabank, with a maturity period of more than six months, but less

than one year.

52 | The National Insurance Board of The Turks and Caicos Islands

31