Page 57 - NIB Annual Report 12-13 | 13-14

P. 57

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

7. Short-term investments, continued

The certificates of deposit earned interest at a rate of 0.60% for the year ended March 31, 2012.

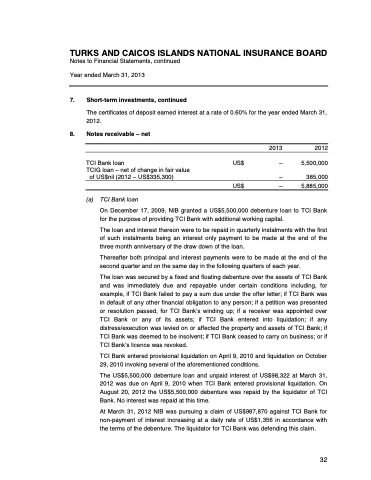

8. Notes receivable – net

TCI Bank loan

TCIG loan – net of change in fair value

of US$nil (2012 – US$335,300)

(a) TCI Bank loan

2013 2012 US$ – 5,500,000

– 385,000 US$ – 5,885,000

On December 17, 2009, NIB granted a US$5,500,000 debenture loan to TCI Bank for the purpose of providing TCI Bank with additional working capital.

The loan and interest thereon were to be repaid in quarterly instalments with the first of such instalments being an interest only payment to be made at the end of the three month anniversary of the draw down of the loan.

Thereafter both principal and interest payments were to be made at the end of the second quarter and on the same day in the following quarters of each year.

The loan was secured by a fixed and floating debenture over the assets of TCI Bank and was immediately due and repayable under certain conditions including, for example, if TCI Bank failed to pay a sum due under the offer letter; if TCI Bank was in default of any other financial obligation to any person; if a petition was presented or resolution passed, for TCI Bank’s winding up; if a receiver was appointed over TCI Bank or any of its assets; if TCI Bank entered into liquidation; if any distress/execution was levied on or affected the property and assets of TCI Bank; if TCI Bank was deemed to be insolvent; if TCI Bank ceased to carry on business; or if TCI Bank’s licence was revoked.

TCI Bank entered provisional liquidation on April 9, 2010 and liquidation on October 29, 2010 invoking several of the aforementioned conditions.

The US$5,500,000 debenture loan and unpaid interest of US$98,322 at March 31, 2012 was due on April 9, 2010 when TCI Bank entered provisional liquidation. On August 20, 2012 the US$5,500,000 debenture was repaid by the liquidator of TCI Bank. No interest was repaid at this time.

At March 31, 2012 NIB was pursuing a claim of US$987,870 against TCI Bank for non-payment of interest increasing at a daily rate of US$1,356 in accordance with the terms of the debenture. The liquidator for TCI Bank was defending this claim.

2013 & 2014 ANNUAL REPORT | 53 32